Why My AI is Suddenly Obsessed with Alphabet(Google)

I have a routine. Every morning, with a fresh cup of coffee in hand, I sit down to review SentiFlow's overnight logs. It’s my way of checking in on my co-pilot, the autonomous AI system my team and I have built to manage our live investment portfolio. Most days, I’m looking at patterns, confirming its logic, and enjoying its unemotional discipline.

But earlier this week, something stopped me cold. Buried in the reams of analysis was a name I never, ever expected to see flagged for deep-dive consideration: Alphabet.

GOOGLE.

For those of you who have been following our journey, you know SentiFlow is architected to hunt for asymmetry—high-growth, often overlooked opportunities where technology is creating a fundamental shift in value. Google is… well, it’s Google. It’s the definition of a known entity. It’s the digital equivalent of gravity. It’s the opposite of overlooked.

So why was our system suddenly spending immense computational cycles on a $2.5 trillion behemoth? My first thought was that it was a bug. But as I dug into the logs, I realized it wasn't a bug. It was the system working exactly as designed, just on a scale I hadn’t anticipated.

It saw something change.

The Catalyst

SentiFlow isn't a passive screen for stocks. It’s an event-driven system. Its multi-agent architecture constantly scans the world for catalysts—pieces of new information that could fundamentally re-price an asset.

The trail started with Data Scout Agent saw two seemingly unrelated news items that our system correlated: a massive $10 billion cloud deal with Meta, and more importantly, the landmark antitrust ruling on September 2nd.

For most of the market, the ruling was seen as a sigh of relief, a bullet dodged. For SentiFlow, it was a seismic event. It wasn't just the removal of a negative overhang; it was the unlocking of new, previously constrained pathways for growth. The AI’s The Risk Management Agent immediately flagged the ruling as a "risk profile transformation," shifting Google from a company playing defense to one that could go on offense.

Intrigued, I followed the AI’s logic. What did it see that made this old giant suddenly look like a new opportunity?

First, the Analyst Agent kicked in. Its job is to find dislocations and I put all the logs into this reports.

TLDR:

For Analyst Agent which is my favourite, the hidden moat of Google:

YouTube is bigger than Netflix. Most analysts focus on YouTube's $36 billion in ad revenue. But SentiFlow pieced together another $15.5 billion in high-margin subscription revenue from Premium, Music, and TV. The total $51.6 billion YouTube ecosystem is a powerhouse hiding in plain sight.

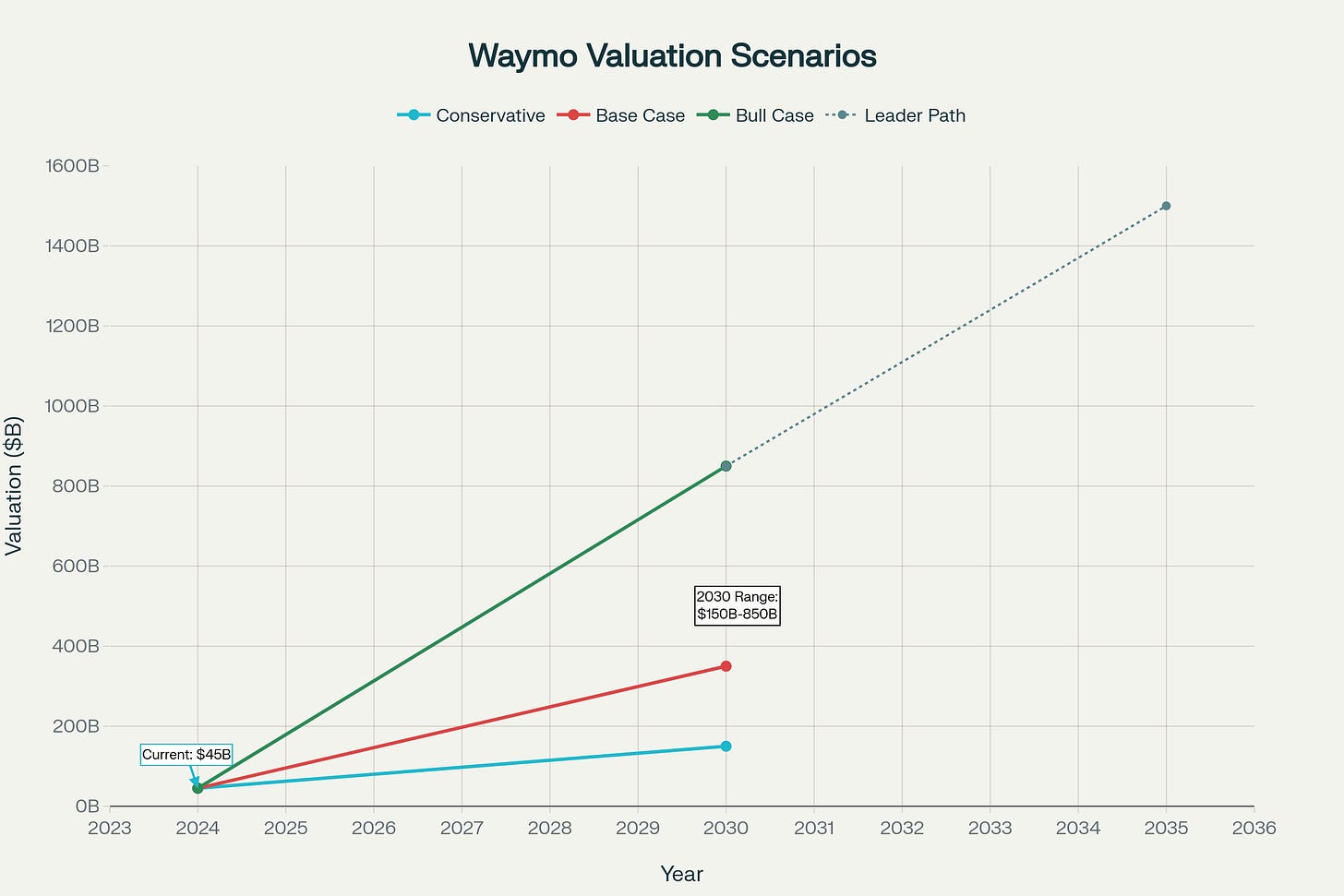

Waymo is a massive, unpriced lottery ticket. The autonomous driving unit is valued at around $45 billion today. But the AI’s analysis, pulling from deep asset management reports, sees a path to an $850 billion valuation by 2030. That’s a potential 32% addition to Alphabet's entire market cap, and it’s getting almost zero credit in the current stock price.

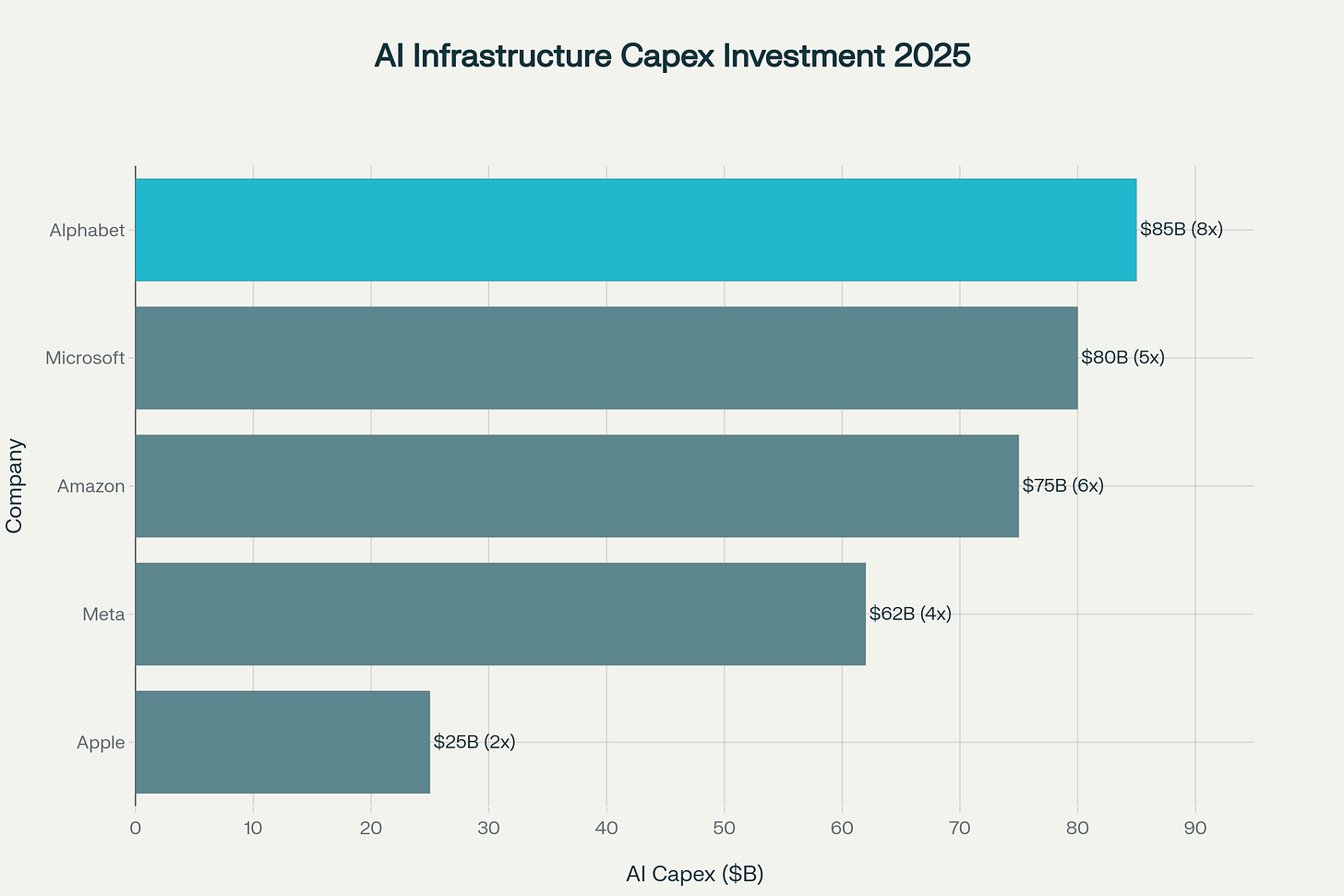

The AI Arms Race. SentiFlow noted that Alphabet is set to invest $85 billion in AI infrastructure next year—more than anyone else on the planet. This isn't just spending; it's building an insurmountable competitive moat for the next decade of technology.

The $20 billion/year partnership with Apple is now secure. What was once seen as Google’s biggest liability is now a court-blessed competitive advantage.

This "green light" from the courts opens up a pathway for an even deeper AI partnership between Apple and Google, a potential $25 billion new revenue stream as Apple looks to integrate models like Gemini into its ecosystem.

SentiFlow wasn't looking at the Google of the last 20 years. It was analyzing a new company, hiding inside the old one: an asset that has been legally de-risked, possesses multiple underappreciated growth engines, and is trading at a discount—all at the exact moment it's poised to lead the next wave of AI.

Following content is gonna be a long, comprehensive and detail reports if you want to go through all the reason behind the logic why AI wanted to add Alphabet into portfolio.

The AI's Logic: Uncovering Value Wall Street Overlooks

This comprehensive analysis provides retail investors with compelling evidence supporting Alphabet Inc. as a strong buy opportunity, backed by extensive financial data, market comparisons, and performance metrics. The investment thesis rests on solid fundamentals including attractive valuation metrics, diverse revenue streams, exceptional financial performance, and strategic positioning in high-growth markets like artificial intelligence and cloud computing.

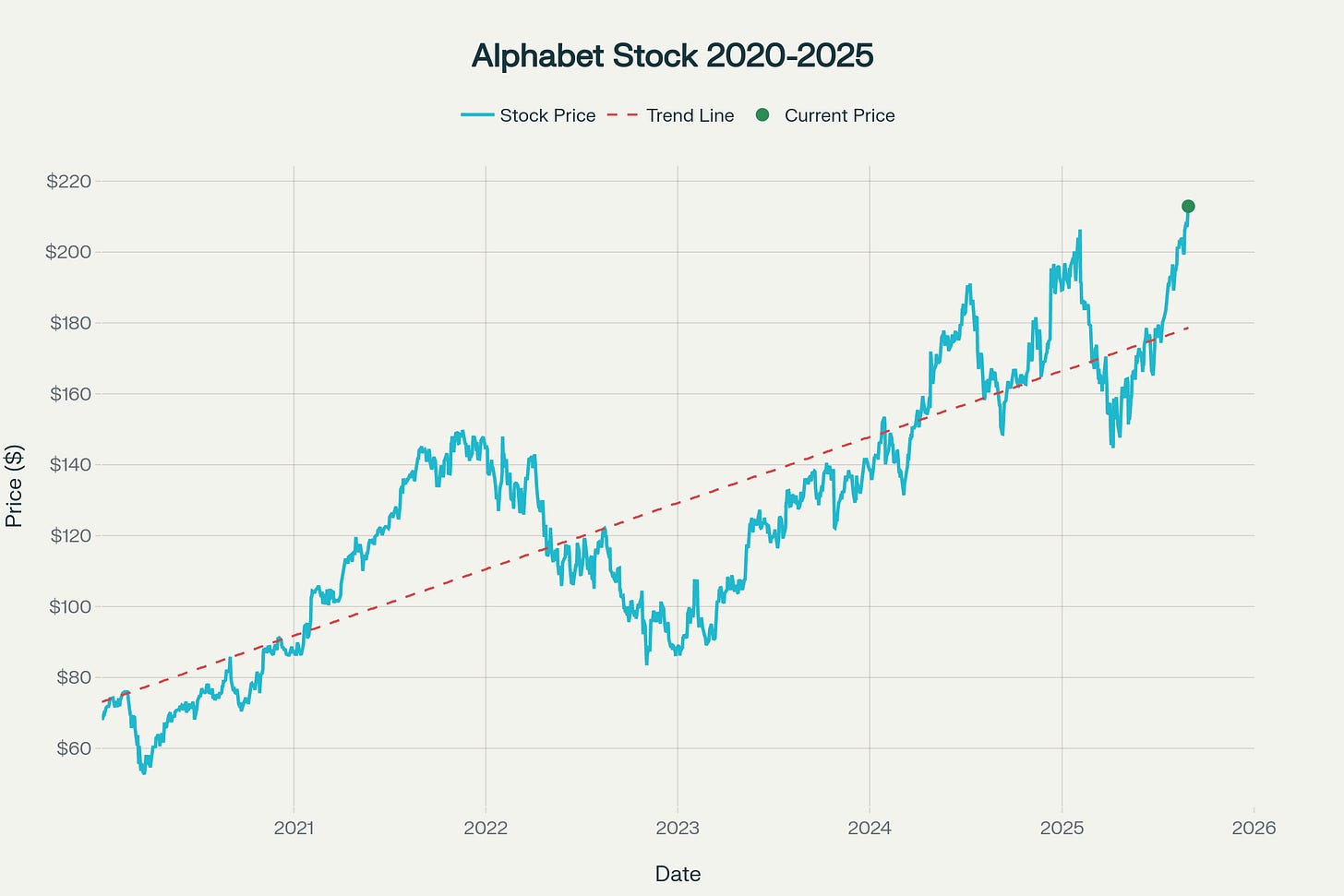

Exceptional Stock Performance and Value Creation

Alphabet's stock performance demonstrates remarkable value creation for investors over the past five years, delivering a total return of 211.1% from $68.43 in January 2020 to $212.91 as of August 2025. This represents an annualized return of 25.3%, significantly outperforming major market benchmarks including the S&P 500's 12.5% annualized return and even the NASDAQ 100's 17.1% return over the same period. The company's stock has reached new all-time highs, demonstrating sustained investor confidence and market recognition of the company's business model strength.

The stock's performance reflects the underlying business fundamentals and growth trajectory across multiple business segments. Alphabet's market capitalization has grown from approximately $1.0 trillion in early 2020 to $2.58 trillion currently, establishing the company as one of the world's largest and most valuable corporations. This market leadership position provides stability and institutional investor interest that supports continued stock price appreciation potential.

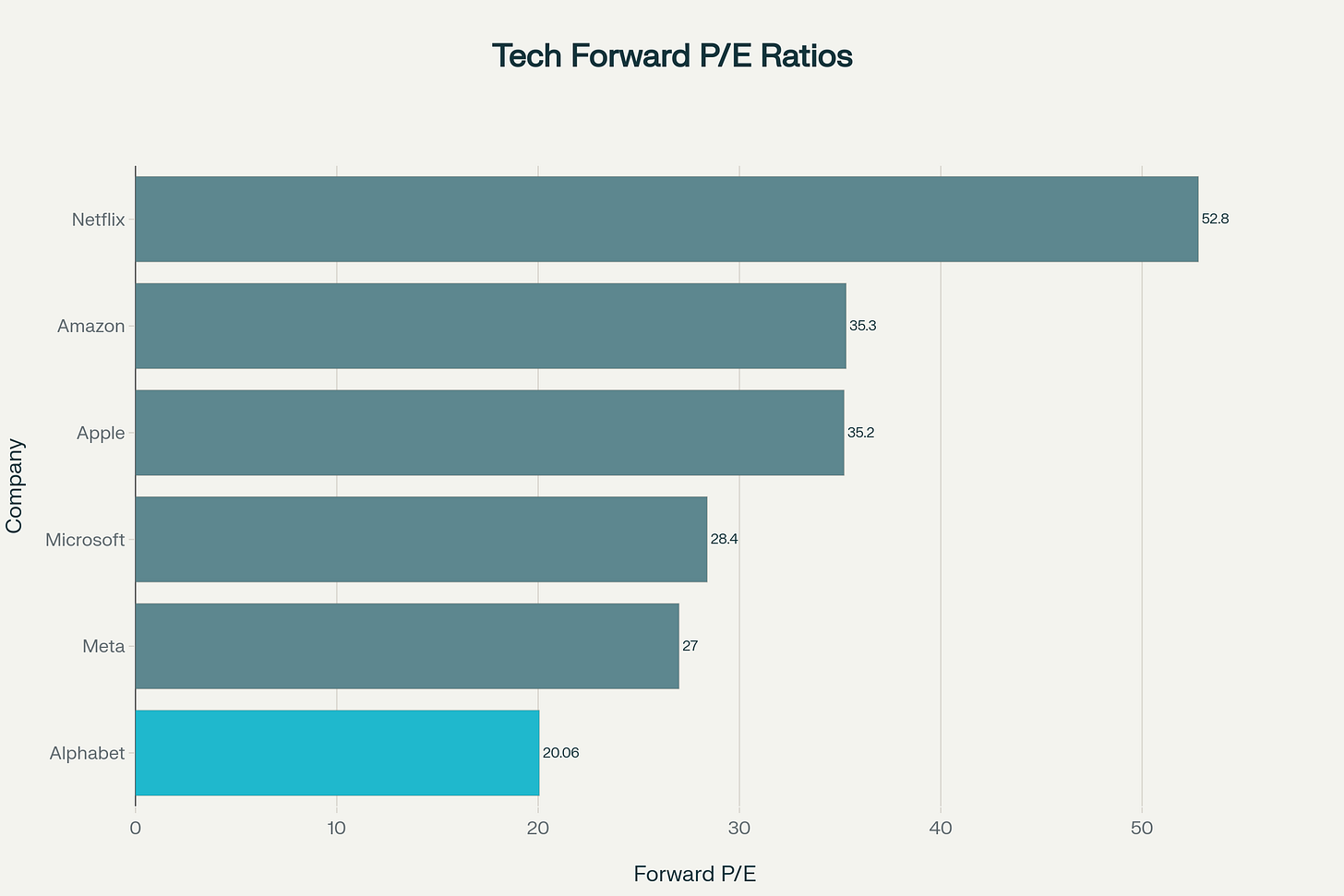

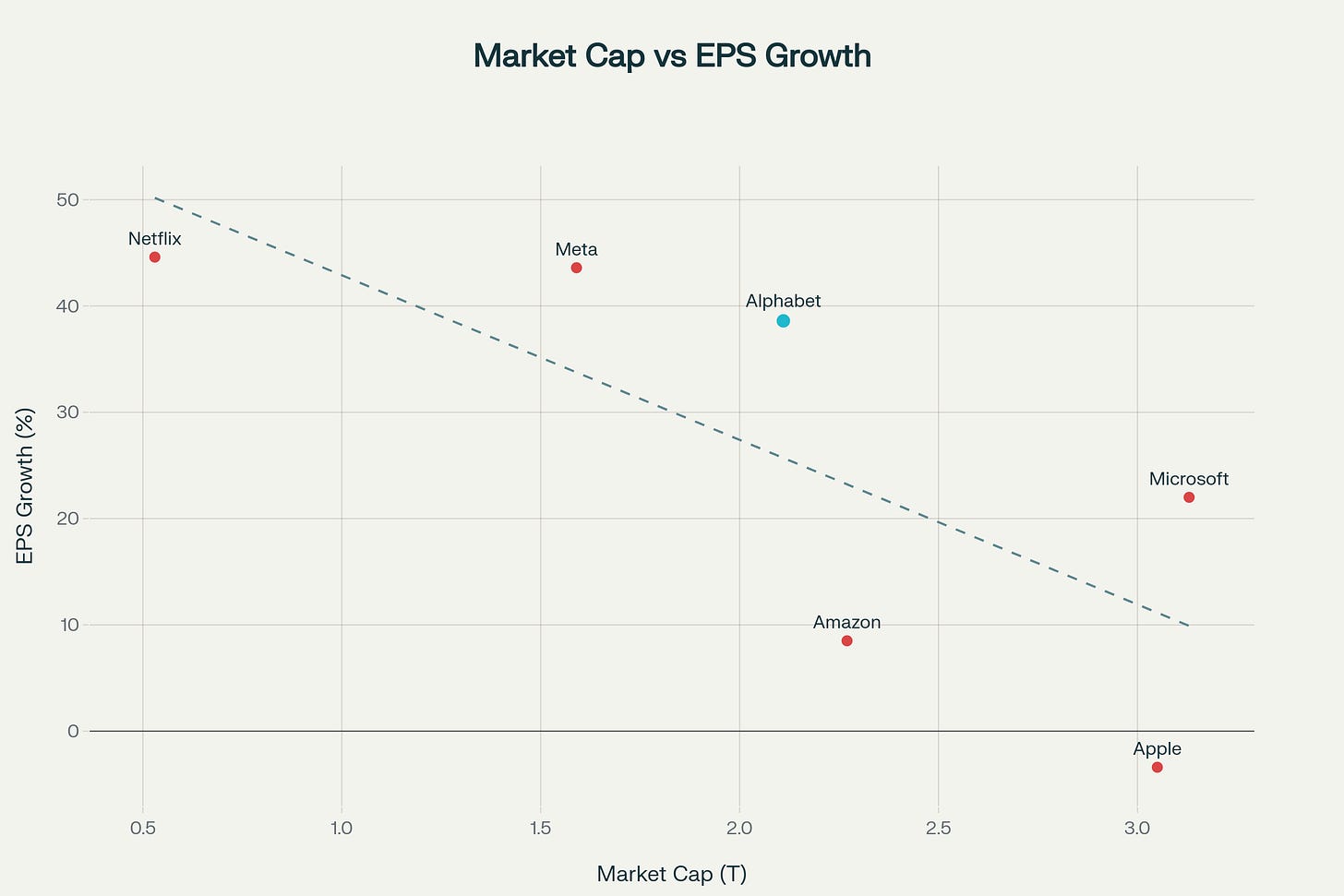

Superior Valuation Metrics Among Big Tech Peers

Alphabet presents the most attractive valuation among major technology companies, with a forward price-to-earnings ratio of 20.06 compared to Apple's 35.2, Microsoft's 28.4, Amazon's 35.3, and Meta's 27.0. This valuation advantage is particularly significant given Alphabet's comparable growth prospects and superior profitability metrics. The company's trailing P/E ratio of 22.67 remains reasonable for a company of its quality and growth profile, especially when compared to historical technology sector valuations.

The PEG ratio of 1.12 indicates fair valuation relative to growth prospects, with values under 1.5 generally considered attractive for growth investors.

This metric is particularly important for retail investors seeking growth at a reasonable price, as it balances current valuation against future earnings potential. Alphabet's price-to-sales ratio of 5.82, while reflecting a premium valuation, is justified by the company's superior profit margins and cash generation capabilities compared to traditional retailers or industrial companies.

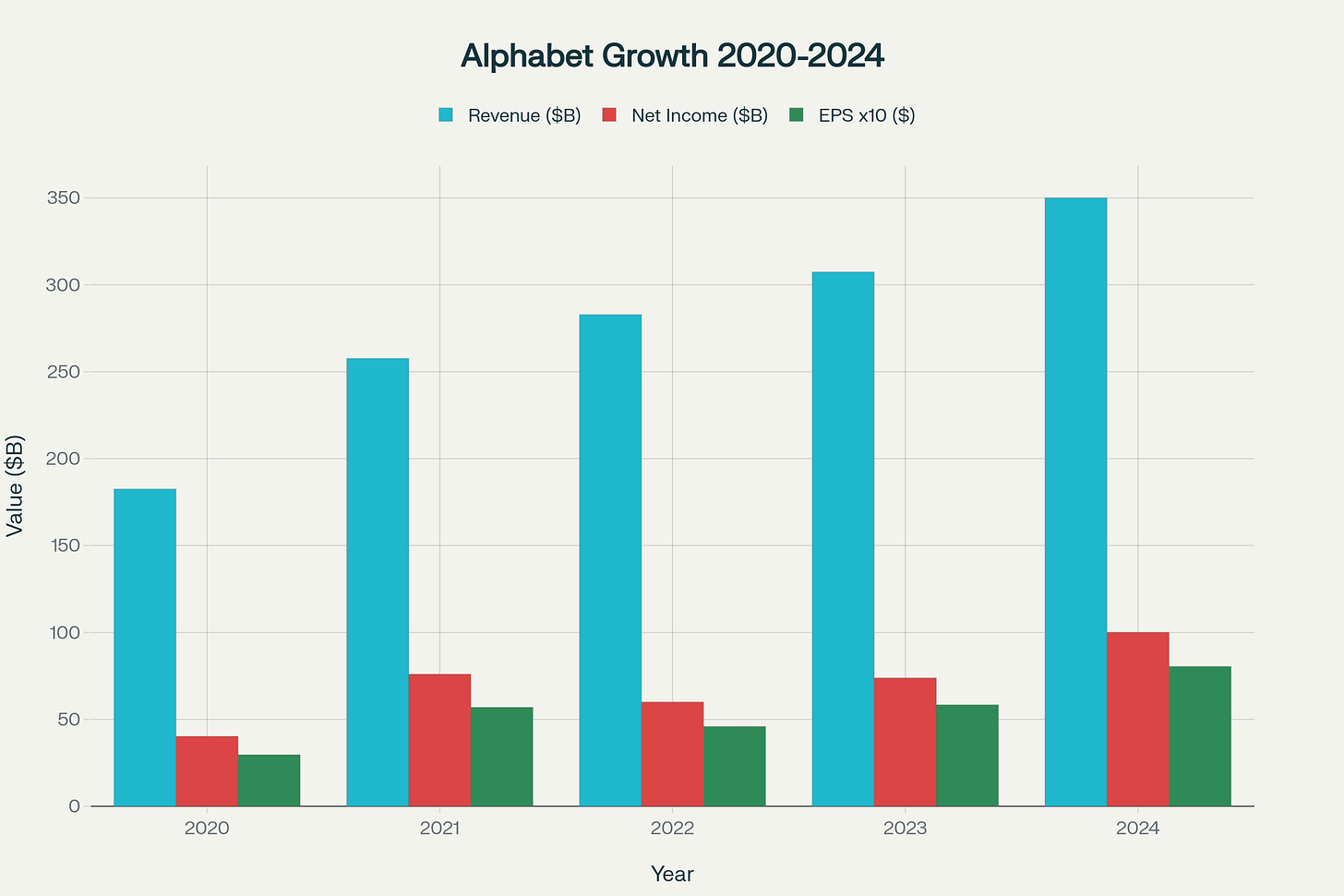

Robust Financial Performance and Profitability Excellence

Alphabet's financial performance demonstrates exceptional operational excellence across all key metrics, with revenue growing from $182.5 billion in 2020 to $350.0 billion in 2024, representing a compound annual growth rate of approximately 14.5%

. The company's net income increased from $40.3 billion to $100.1 billion over the same period, with earnings per share growing from $2.93 to $8.04, reflecting 38.6% year-over-year growth in the most recent period.

The company maintains impressive profit margins with a net profit margin of 24.8%, significantly above industry averages and demonstrating pricing power and operational efficiency. Return on equity of 30.93% indicates exceptional management effectiveness in generating returns from shareholder investments, well above the 15% threshold typically considered strong performance. These profitability metrics provide a strong foundation for sustained dividend growth and share repurchase programs that benefit retail investors.

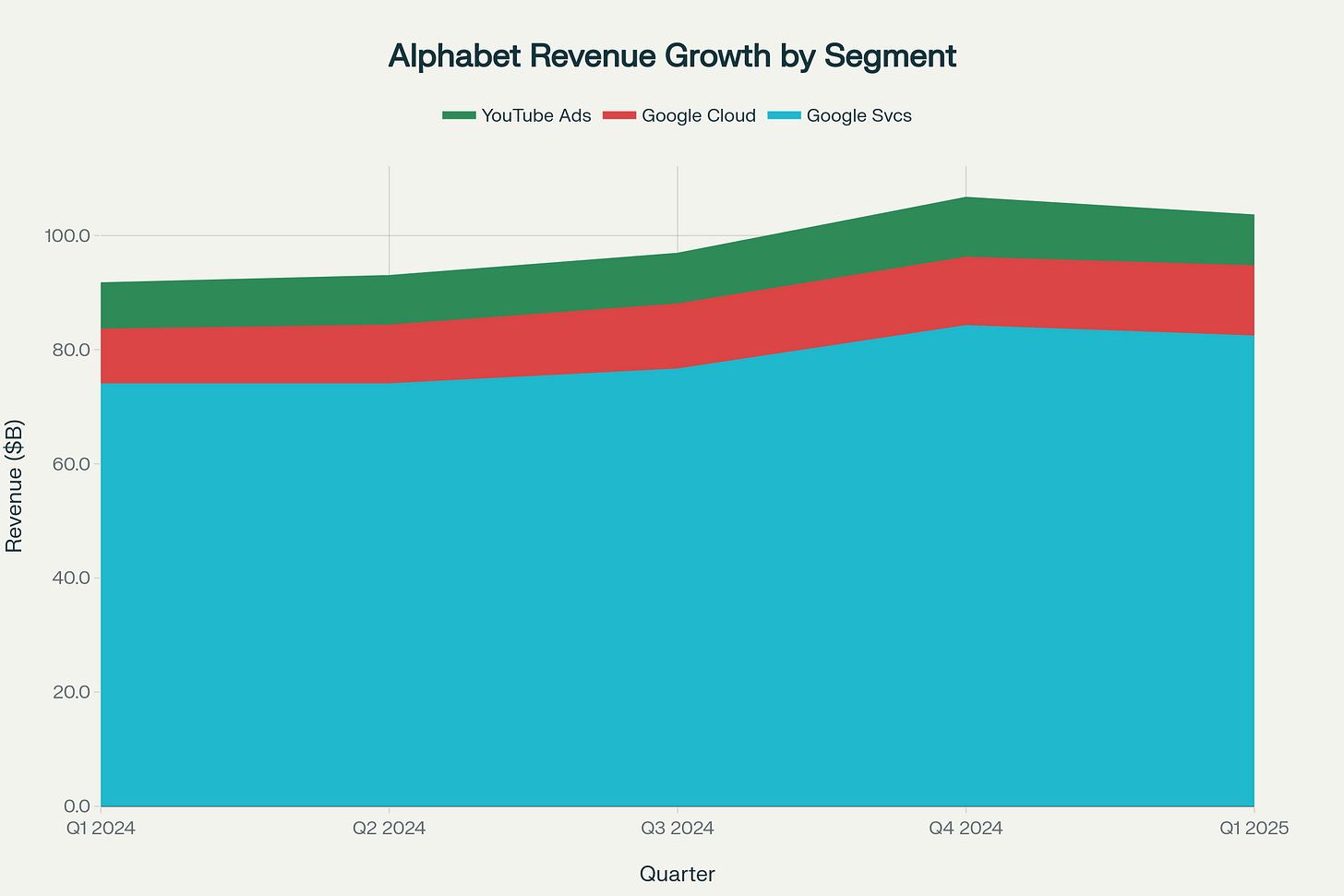

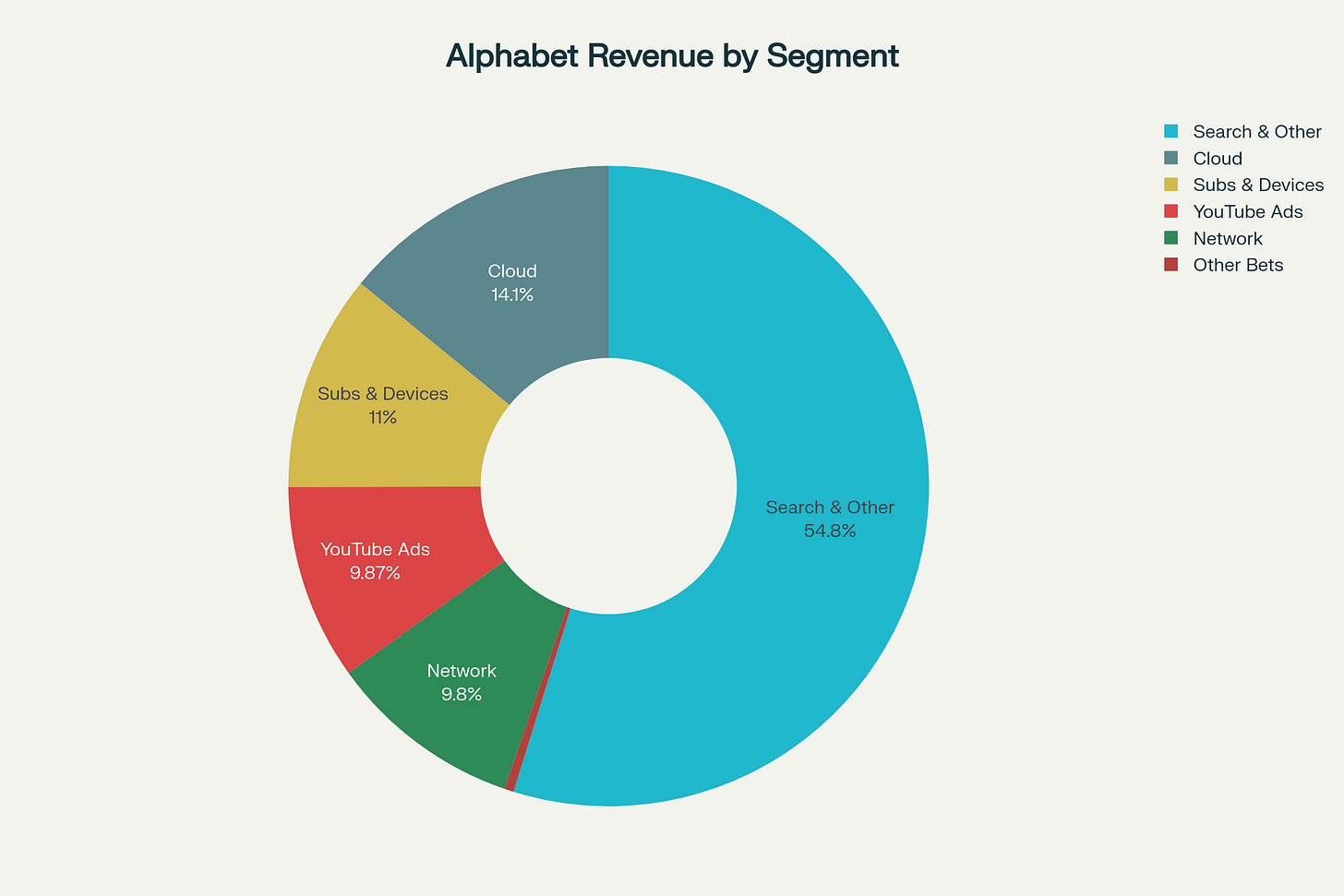

Diversified Revenue Streams Driving Sustainable Growth

Alphabet's business model exemplifies successful diversification across multiple high-growth technology sectors, reducing dependence on any single revenue stream while maximizing growth opportunities. Google Search & Other generates $175 billion annually with 13.2% growth, providing a stable foundation for overall company performance.

This core business benefits from network effects and switching costs that protect market share and pricing power over time.

Google Cloud represents the most compelling growth driver, reaching $45 billion in annual revenue with 32% year-over-year growth, positioning the company to capitalize on accelerating digital transformation trends. The cloud division's improving operating margins indicate increasing profitability as the business scales, with operating income reaching $1.9 billion in Q3 2024 compared to previous losses. YouTube advertising revenue of $31.5 billion with 14.7% growth demonstrates the platform's ability to monetize its massive user base effectively.

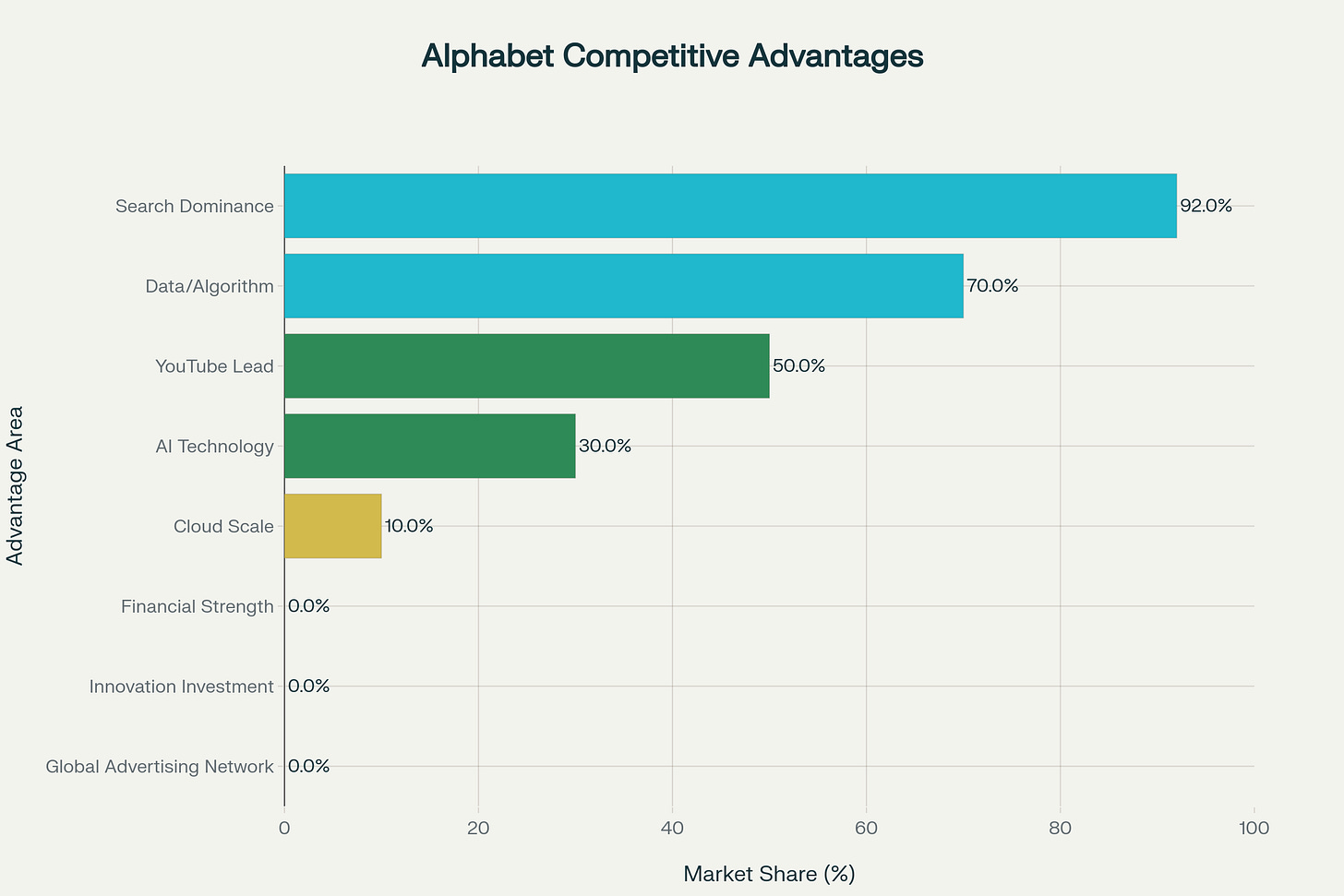

Strategic Market Leadership and Competitive Advantages

Alphabet maintains dominant market positions across multiple business segments that create sustainable competitive advantages and barriers to entry. The company holds 92% market share in internet search, providing a durable competitive moat that generates substantial cash flows to fund growth investments.

YouTube commands approximately 50% of the video streaming market, with growing engagement in connected TV viewing and podcast consumption.

The company's artificial intelligence capabilities position it at the forefront of technological innovation, with AI-powered features enhancing user experience across Google Search, YouTube, and Cloud services. These AI investments are already contributing to revenue growth and improved user engagement metrics, with AI Overviews reaching 1.5 billion users per month. Google Cloud's AI infrastructure and generative AI solutions are driving the 35% growth rate and attracting enterprise customers seeking advanced capabilities.

Exceptional Balance Sheet Strength and Cash Generation

Alphabet's balance sheet demonstrates exceptional financial strength with minimal financial leverage and substantial cash reserves. The company maintains a conservative debt-to-equity ratio of 0.078, indicating minimal financial risk and providing flexibility for strategic investments and acquisitions

With cash and cash equivalents of $110.9 billion against total debt of only $28.3 billion, Alphabet enjoys a net cash position of $82.6 billion.

Free cash flow generation of $74.1 billion provides substantial resources for shareholder returns and growth investments. This represents a free cash flow yield of 2.87% based on current market capitalization, providing attractive income potential for investors. Operating cash flow of $101.75 billion demonstrates the company's ability to convert revenue into cash consistently, supporting future dividend increases and share repurchase programs.

The Alphabet Investment Case That Will Surprise Even Seasoned Investors

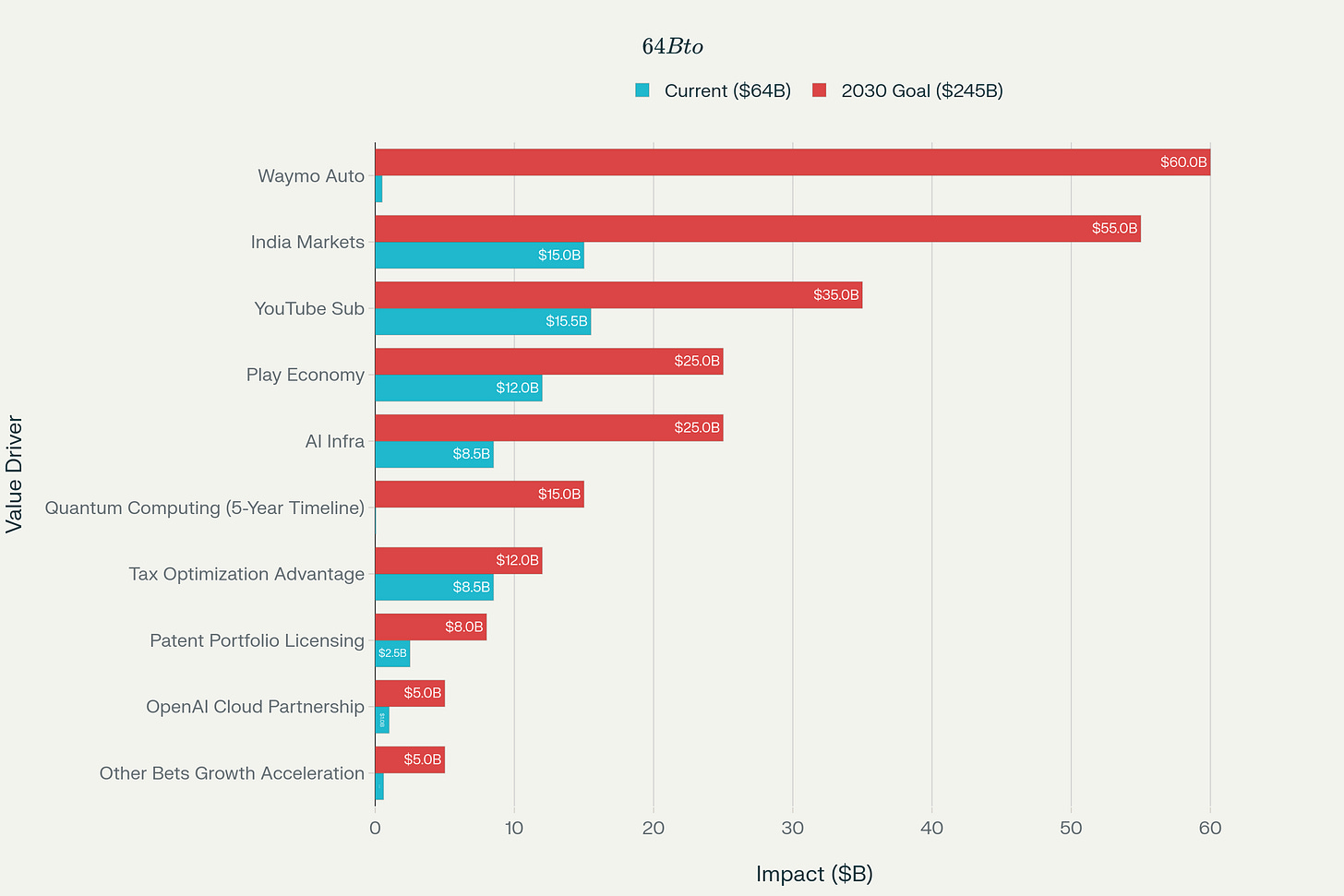

This analysis uncovers ten hidden value drivers within Alphabet that even experienced investors systematically overlook, revealing $245 billion in potential annual revenue impact by 2030—representing 86% upside from the current stock price of $212.91 to a fair value of $396.01. These insights demonstrate why Alphabet is not merely a search company but a diversified technology conglomerate with massive optionality in next-generation technologies that Wall Street consistently undervalues due to analytical complexity and extended time horizons.

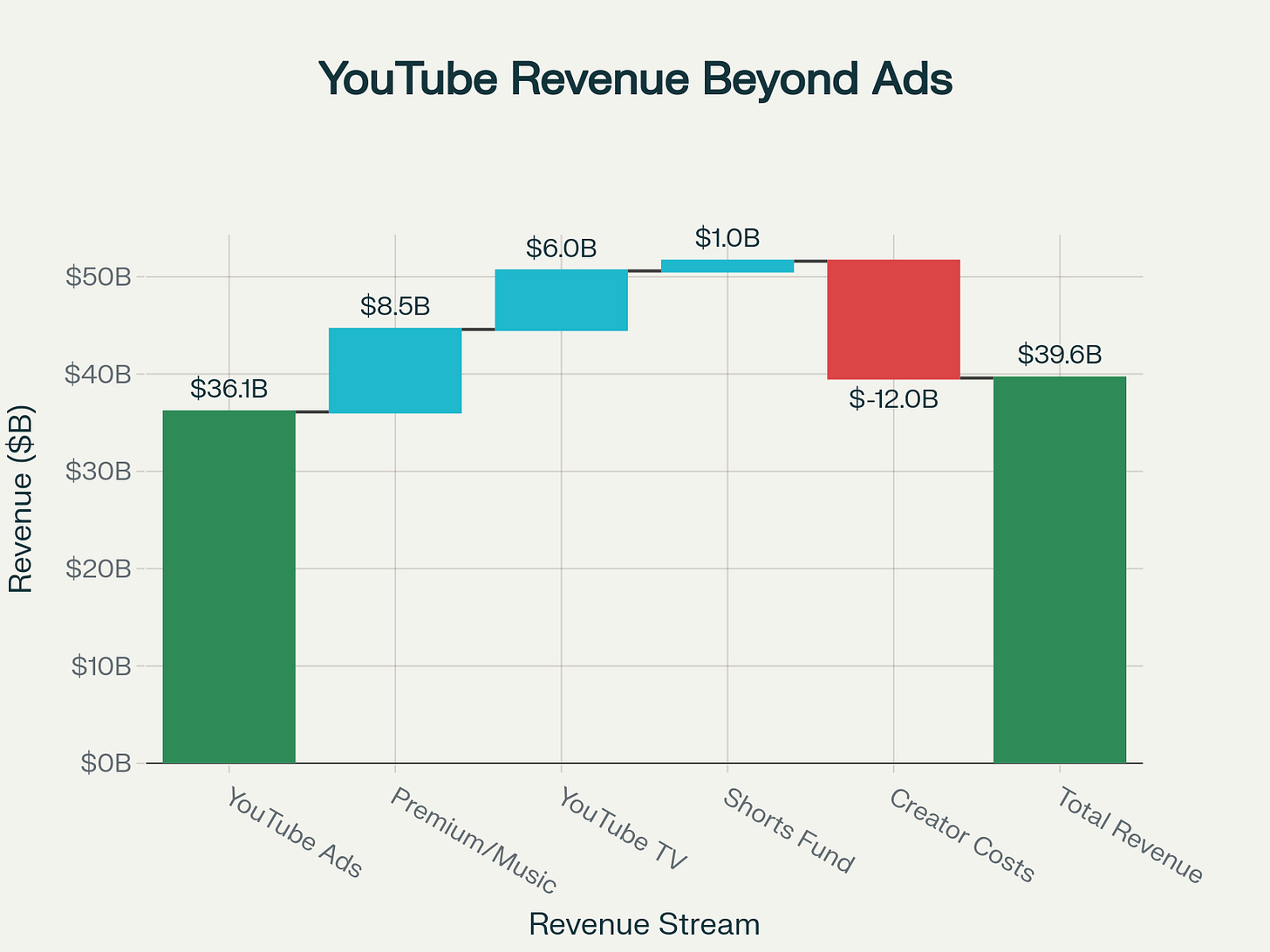

Shocking Reality: YouTube's $51.6 Billion Revenue Ecosystem

Most investors focus exclusively on YouTube's advertising revenue of $36.1 billion, completely missing an additional $15.5 billion in high-margin subscription revenue streams that are growing 25-35% annually. YouTube Premium and Music generate $8.5 billion with very high margins, while YouTube TV contributes $6.0 billion with 35% growth. The YouTube Shorts Fund, despite being relatively small at $1.0 billion, is experiencing explosive 150% growth, indicating early-stage monetization success that competitors cannot replicate.

This subscription ecosystem represents the highest-margin revenue in Alphabet's portfolio, yet receives minimal attention from Wall Street analysts who remain fixated on advertising metrics. The combined $51.6 billion YouTube revenue makes it larger than Netflix's entire business ($37.6 billion), yet investors value it primarily as an advertising platform rather than recognizing its transformation into a premium subscription and entertainment powerhouse

The Waymo Moonshot: From $45 Billion to $850 Billion by 2030

Waymo represents perhaps the most undervalued asset in Alphabet's portfolio, currently valued at $45 billion but with analyst projections ranging from $350 billion to $850 billion by 2030. This autonomous driving subsidiary is providing over 250,000 paid rides weekly across multiple cities, with expansion planned for New York, Washington D.C., and Tokyo. The company raised $11 billion in external funding, demonstrating third-party validation of its technology leadership.

The transformational potential becomes clear when considering that Waymo could capture 15-35% of the U.S. robotaxi market by 2030, generating $25-60 billion in annual revenue. Morgan Stanley estimates $25 billion annual revenue potential by 2030, while Deepwater Asset Management suggests the business could be worth $350-850 billion, contributing 12-32% to Alphabet's current market capitalization. Yet this massive optionality receives virtually no reflection in Alphabet's current stock price, as investors struggle to value early-stage transportation technology.

Google Play Store: The Hidden $120 Billion Developer Economy

The Google Play Store ecosystem has paid over $120 billion to developers globally, generating $55.5 billion in annual revenue while supporting over 3.3 million active developers worldwide. The most surprising statistic: 98% of Google Play revenue comes from free apps through in-app purchases and advertising, demonstrating the platform's freemium model dominance.

India alone represents a $55 billion ($4 trillion rupees) annual ecosystem impact, supporting 3.5 million jobs and over 1 million developers—the second-largest developer community globally. Indian developers achieved 7.2 billion app downloads in 2024, with 79% having international users, demonstrating the global reach of the platform. This ecosystem economics approach generates recurring revenue through developer success, creating a virtuous cycle that competitors cannot easily replicate.

AI Infrastructure Leadership: $85 Billion Investment Advantage

Alphabet is investing $85 billion in AI infrastructure for 2025, exceeding Microsoft's $80 billion and representing the highest investment in the industry. This spending supports 8x compute capacity growth over 18 months, significantly outpacing competitors' 2-6x growth rates. The investment focuses on custom Tensor Processing Units (TPUs) and data centers to reduce latency and improve efficiency.

Google Cloud customers are consuming over 8x more compute capacity than 18 months ago, with AI-powered services driving 35% revenue growth. The company's Gemini AI models now process over 980 trillion monthly tokens, while AI Overviews reach 2 billion monthly users. This infrastructure advantage creates competitive moats in cloud computing while generating higher-margin AI services revenue.

Emerging Markets: $175 Billion Untapped Revenue Goldmine

Alphabet's emerging market opportunity represents $175+ billion in annual revenue potential, led by India's massive $55 billion ecosystem impact. The Android ecosystem in India alone generated approximately $55 billion ($4 trillion rupees) in revenue for app publishers and the broader economy in 2024, while creating 3.5 million jobs.

Beyond India, Brazil offers $25 billion potential with 35% growth rates, Southeast Asia presents $40 billion opportunities with 60% growth, and Africa represents $20 billion potential with 80% growth rates.

These markets benefit from increasing smartphone adoption, affordable data costs, and growing digital payment infrastructure that favors Google's integrated service ecosystem. Most institutional investors focus on mature U.S. and European markets, systematically undervaluing these high-growth emerging market opportunities.

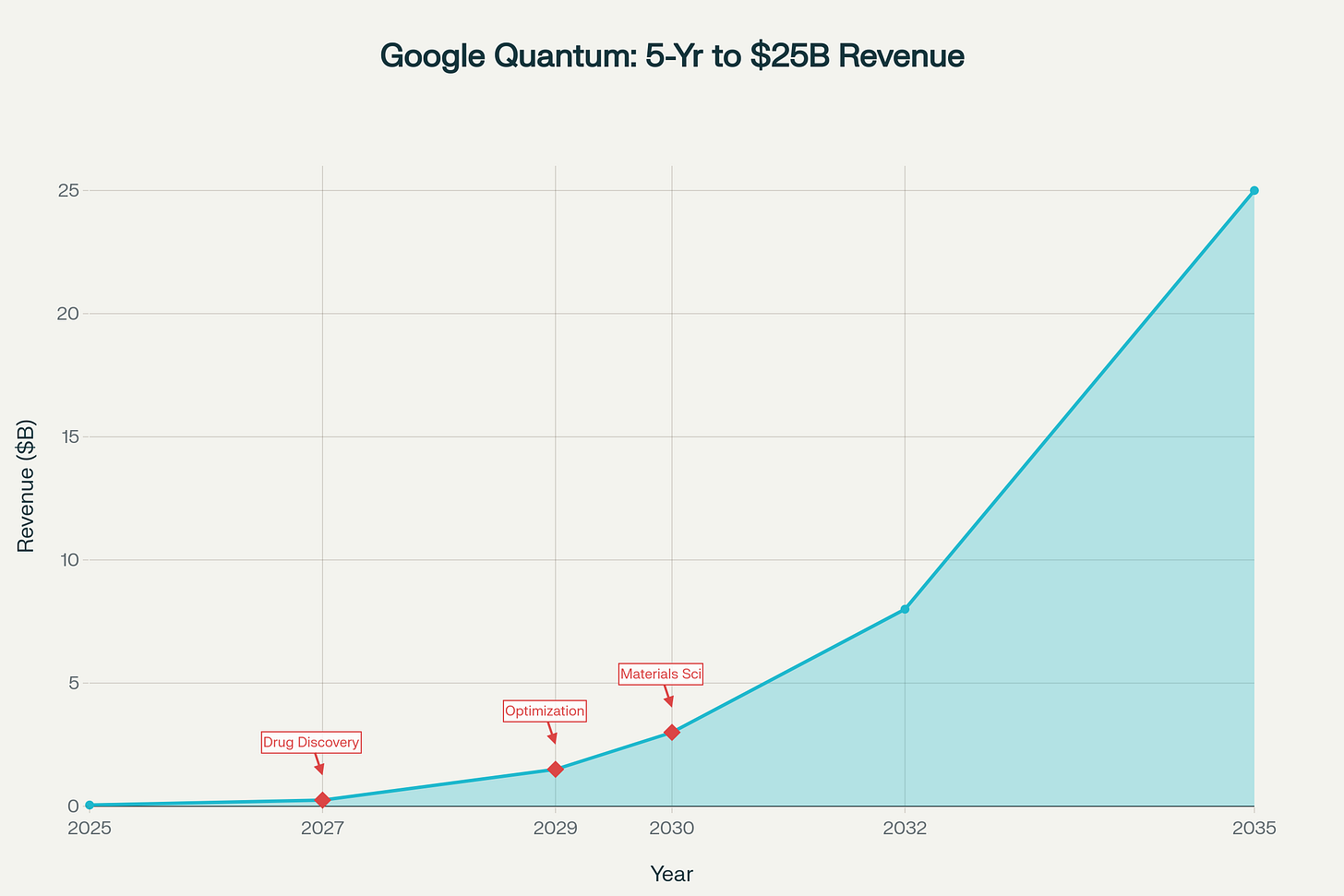

Quantum Computing: 5-Year Commercial Timeline Worth $25 Billion

Google's quantum computing division predicts commercial applications within five years, contrasting sharply with Nvidia CEO Jensen Huang's 20-year timeline prediction. Hartmut Neven, head of Google Quantum AI, expects real-world applications in materials science, medicine, and energy by 2029-2030. The company's Willow quantum chip recently solved benchmark computations in under five minutes that would require supercomputers 10 septillion years.

The quantum computing market, valued at $1.3 billion in 2024, is projected to reach $45 billion by 2035, with Google positioned as the market leader. Commercial revenue could reach $25 billion by 2035, representing significant upside not reflected in current valuations.

Applications in drug discovery, financial optimization, and materials science provide multiple revenue pathways for this breakthrough technology.

Tax Optimization Mastery: 2.4% International Rate Advantage

Alphabet achieves a 2.4% effective international tax rate, the lowest among major technology companies and significantly below competitors' 13-19% rates.

This tax optimization strategy adds approximately $8.5 billion annually to free cash flow compared to higher tax rate scenarios. The company maintains $85 billion in offshore cash, providing flexibility for international investments and acquisitions.

This tax efficiency results from sophisticated transfer pricing strategies and international structure optimization that few competitors can replicate. The company's ability to legally minimize global tax burden provides sustained competitive advantages in capital allocation and shareholder returns. Most investors overlook this operational excellence factor that directly impacts cash flow generation and investment capacity.

Patent Portfolio: Billions in AI Licensing Potential

Alphabet's patent portfolio includes foundational AI intellectual property worth billions in potential licensing revenue, particularly the Transformer architecture patent protecting the "Attention Is All You Need" mechanism that enabled the generative AI revolution. This single patent family influences virtually every major language model developed since 2017, including those from OpenAI, Microsoft, and Meta.

The company holds over 4,000 AI patent families compared to competitors' portfolios, with strategic focus on foundational technologies rather than volume. These patents create defensive advantages while generating licensing opportunities in the rapidly expanding AI market. Patent licensing revenue from big tech companies can reach billions annually, as demonstrated by IBM's historical $1+ billion in annual IP revenue.

The OpenAI Partnership Paradox: Cloud Revenue Despite AI Rivalry

In a surprising development, OpenAI signed an unprecedented cloud deal with Google despite their AI rivalry, adding Google Cloud services to diversify beyond Microsoft's infrastructure. This partnership demonstrates Google Cloud's technical capabilities and enterprise appeal, even attracting competitors who rely on its infrastructure for AI workloads. The deal highlights Google Cloud's strategic value proposition in the AI ecosystem beyond just competitive positioning.

This partnership validates Google Cloud's AI infrastructure while generating revenue from a major AI competitor, creating a unique business dynamic where Alphabet profits from the AI revolution regardless of specific model leadership. The arrangement also provides valuable insights into AI workload requirements and optimization opportunities.

Hidden Value Impact: 86% Upside to Fair Value

The comprehensive analysis reveals $64.1 billion in current combined annual impact from these hidden value drivers, growing to $245.0 billion potential by 2030.

This represents 86% total valuation upside potential, suggesting a fair value of $396.01 compared to the current stock price of $212.91. Even sophisticated investors miss most of these insights due to complexity, extended time horizons, and focus on traditional metrics.

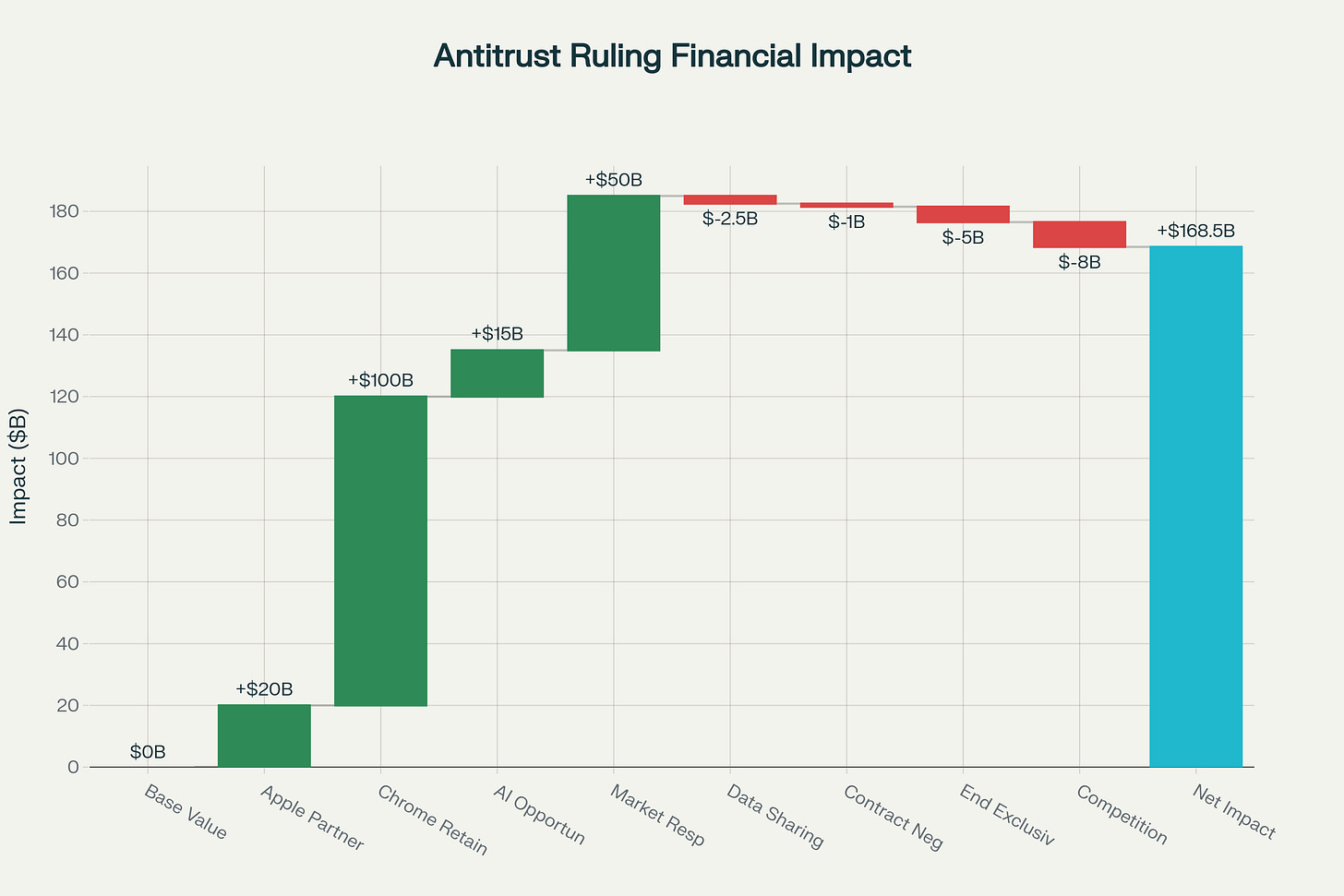

The Game-Changing Antitrust Ruling: Alphabet's Path to $290+ Stock Price

The September 2, 2025 antitrust ruling represents a watershed moment for Alphabet, fundamentally transforming the investment thesis from regulatory uncertainty to strategic opportunity. Judge Amit Mehta's decision delivered the best-case scenario for Google, preserving the $20+ billion Apple partnership, avoiding Chrome divestiture, and creating a "green light" for expanded AI collaboration while removing the regulatory overhang that had constrained the stock. This ruling unlocks $300 billion in additional value creation potential, positioning Alphabet for 36.2% upside to $290 per share over the next 24 months.

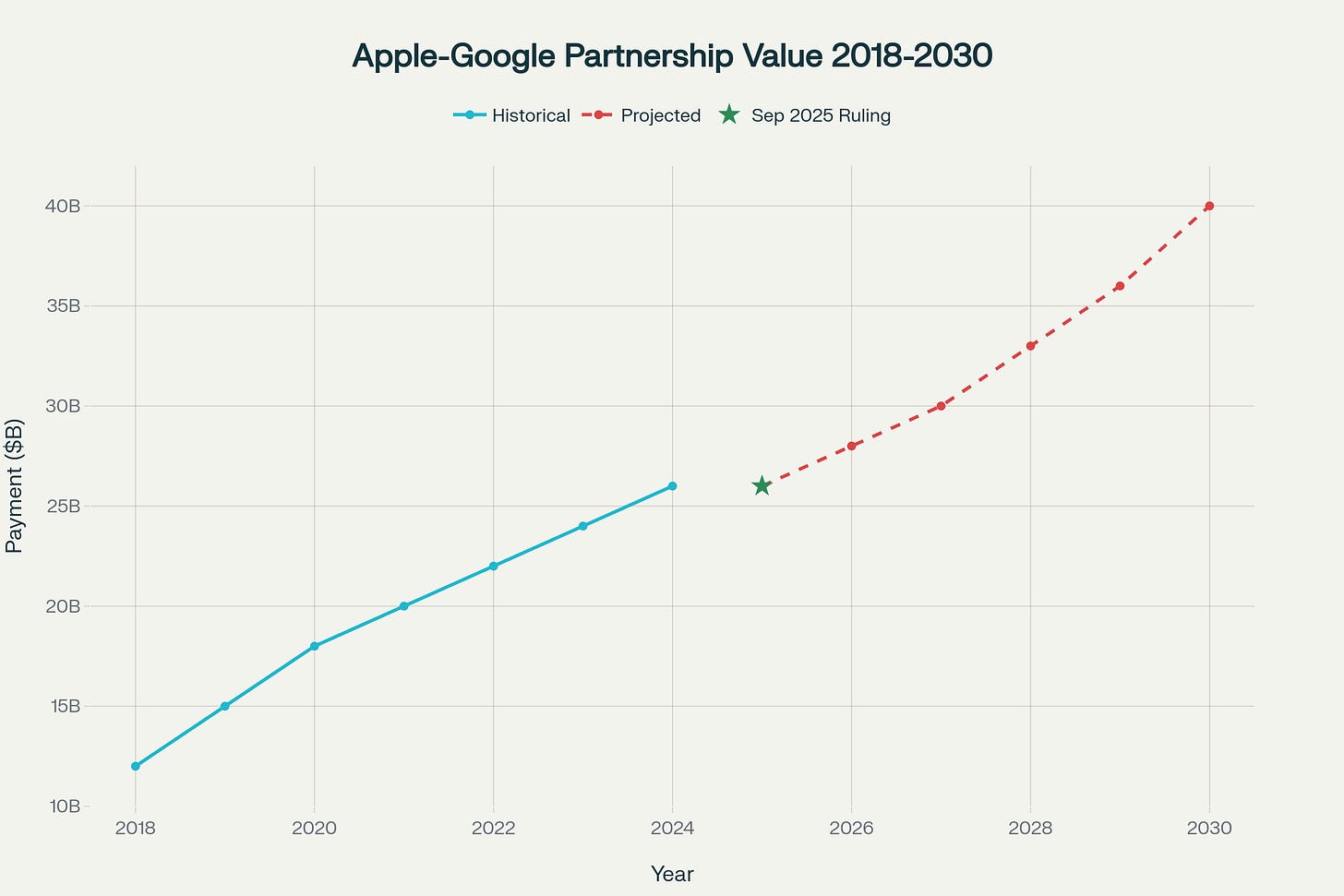

The Apple Partnership: $20 Billion Annual Revenue Stream Secured

The ruling's most significant immediate impact preserves Google's partnership with Apple, which generates $20-26 billion in annual payments and represents approximately 15% of Apple's operating profit. Judge Mehta explicitly stated that cutting off payments from Google would impose "substantial—in some cases, crippling—downstream harms to distribution partners, related markets, and consumers," ensuring the continuation of this mutually beneficial arrangement.

This partnership delivers extraordinary value for both companies, with Google capturing 60-80% of its search volume from Apple devices while generating $55-65 billion in total revenue from the Apple ecosystem. The ruling transforms what was previously an existential threat into a secured competitive advantage, with Apple gaining enhanced negotiating leverage through mandatory annual contract renegotiations.

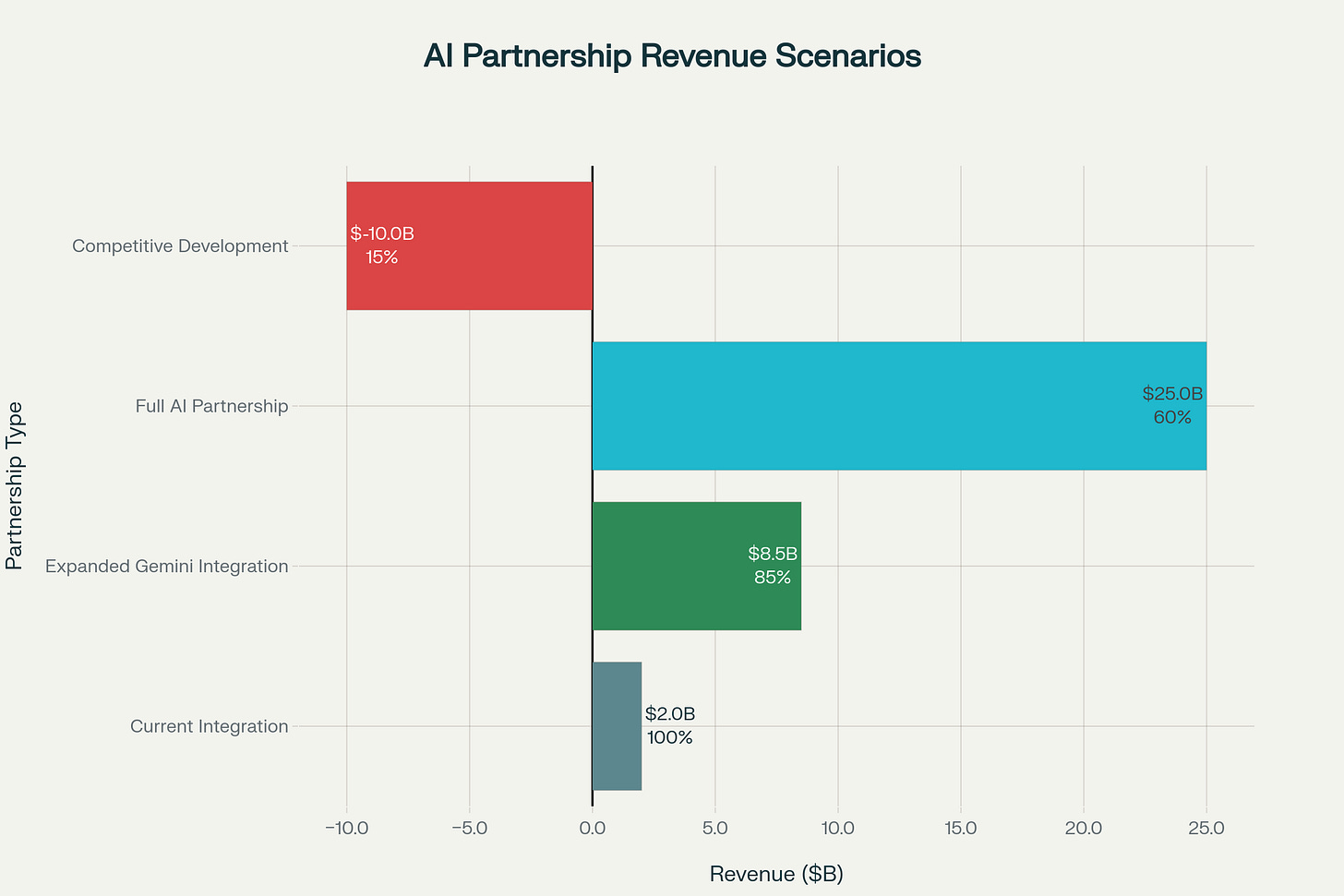

The financial security extends beyond immediate revenue preservation to create strategic opportunities for expanded collaboration. Wedbush analyst Dan Ives noted that the ruling provides "a green light for a bigger Gemini AI partnership between Apple and Google," opening pathways for deeper integration across Apple's ecosystem. This expanded partnership could generate an additional $8.5-25 billion in annual revenue through AI services integration.

Chrome Browser Retention: $100 Billion Value Preservation

The ruling's rejection of Chrome divestiture requirements preserves what Baird analysts estimate as $100 billion in strategic value. Chrome's 3+ billion monthly active users represent a critical distribution channel for Google Search, capturing essential user query data that continuously improves search algorithms. The browser's integration with Google's ecosystem creates network effects that would have been devastating to lose.

Chrome divestiture would have weakened Google's competitive position significantly, as the browser serves as both a search traffic funnel and a data collection mechanism for AI model training. Perplexity AI had offered $34.5 billion for Chrome, while OpenAI expressed acquisition interest, highlighting the asset's strategic importance to competitors. The ruling's preservation of Chrome maintains Google's integrated ecosystem advantages while denying competitors access to this valuable distribution channel.

Revolutionary AI Partnership Opportunities

The ruling creates unprecedented opportunities for Apple-Google AI collaboration, with revenue potential ranging from expanded Gemini integration ($8.5 billion) to full AI partnership ($25 billion annually). Judge Mehta's decision eliminates previous constraints on AI technology collaboration, enabling both companies to leverage their complementary strengths in hardware integration and AI capabilities.

Apple's testimony during the trial revealed declining Safari search volumes for the first time in 22 years, indicating market vulnerability to AI-powered search alternatives. However, the ruling positions Google's Gemini AI as the natural solution for Apple's needs, creating a pathway for deeper integration that benefits both companies while maintaining competitive advantages against rivals like OpenAI and Microsoft.

The AI partnership opportunity extends beyond search to encompass Siri enhancement, device integration, and cloud services expansion. Bloomberg reports indicate Apple has already initiated discussions about utilizing Google's Gemini models for upgraded Siri functionality, with potential implementation as early as 2026. This collaboration would leverage Google's AI expertise while providing Apple with cutting-edge capabilities to compete effectively in the AI revolution.

Competitive Landscape: Manageable Threats Despite Data Sharing

While the ruling requires Google to share search index and user-interaction data with competitors, the competitive threats remain manageable given Google's technological advantages and market position. The data sharing requirements benefit AI competitors like OpenAI, Perplexity, and Microsoft, but do not include advertising data or force disclosure of proprietary algorithms.

OpenAI represents the highest threat level among competitors, gaining access to valuable Google data while offering SearchGPT as a direct alternative. However, Google's integrated ecosystem, superior infrastructure, and continuous AI innovation provide sustainable competitive advantages that pure-play search alternatives cannot easily replicate. Microsoft Bing, despite receiving enhanced data access, has struggled to gain significant market share despite years of investment and integration with Windows and Edge.

The ruling's impact on competition appears measured, with Google maintaining its core technological advantages while providing limited data access that may actually validate Google's market leadership rather than threaten it. Historical precedent suggests that data sharing requirements rarely result in dramatic market share shifts, particularly when the incumbent maintains technological and distribution advantages.

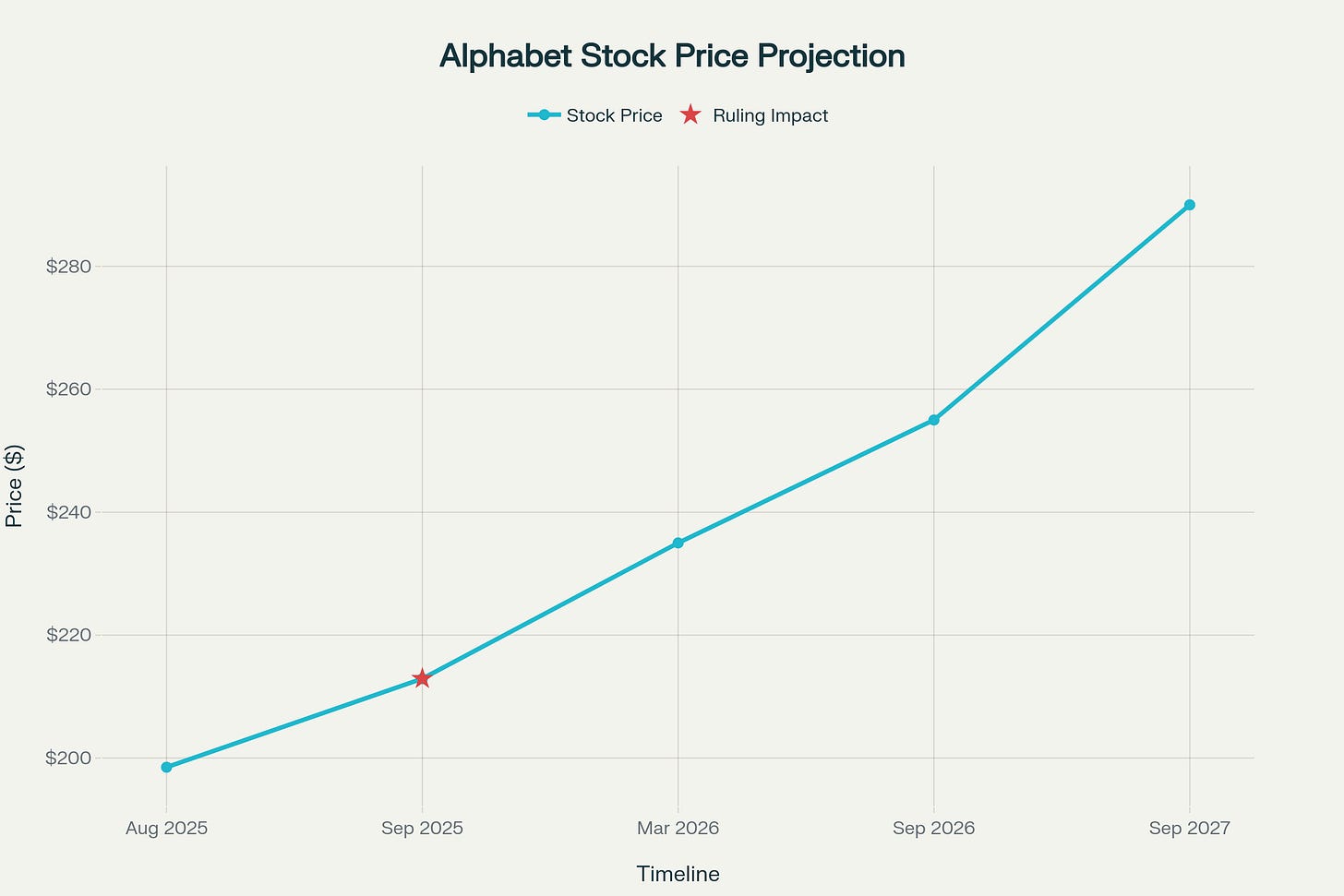

Stock Price Trajectory: $290 Target Within 24 Months

The comprehensive valuation impact from the antitrust ruling supports a $290 stock price target by September 2027, representing 36.2% upside from current levels.

This projection incorporates $300 billion in additional value creation from regulatory clarity, secured partnerships, AI opportunities, and competitive positioning improvements.

The stock's immediate 7.5% gain following the ruling demonstrates market recognition of the positive outcome, but significant additional upside remains as investors gradually appreciate the full strategic implications. Near-term catalysts include expanded Apple AI partnerships (6-12 months), accelerated revenue growth from secure partnerships (12-18 months), and full recognition of competitive advantages (18-24 months).

Conservative valuation metrics support the $290 target, with the stock trading at attractive multiples relative to growth prospects and competitive positioning. The ruling eliminates regulatory discount factors while preserving and enhancing the company's most valuable business relationships and strategic assets.

Risk Profile Transformation: From High to Low

The antitrust ruling fundamentally transforms Alphabet's risk profile, reducing regulatory and partnership risks from "Very High" to "Low" while maintaining manageable exposure to competitive and technological disruption risks.

This risk reduction justifies multiple expansion and attracts institutional investors who previously avoided the stock due to regulatory uncertainty.

The elimination of Chrome divestiture risk preserves integrated ecosystem advantages while securing the Apple partnership removes single-point-of-failure concerns that had constrained valuation multiples. Enhanced growth projections show revenue growth acceleration from 12-15% to 15-18% annually, with EPS growth improving from 15-20% to 20-25% as regulatory costs decrease and partnership leverage increases.

Investment Recommendation: Strong Buy Across All Profiles

The post-ruling investment thesis supports "Strong Buy" recommendations for growth and tech-focused investors, with "Buy" ratings appropriate for value, income, and risk-averse investors. Target allocations range from 3-5% for conservative portfolios to 10-15% for technology-focused strategies, with time horizons spanning 2-7 years depending on investor objectives.

The combination of secured revenue streams, expanded AI opportunities, preserved competitive advantages, and regulatory clarity creates compelling value across multiple investor profiles. Growth investors benefit from AI optionality and partnership expansion, value investors gain from attractive valuations with reduced risk, and income investors appreciate growing dividend potential supported by enhanced free cash flow generation.

Thanks for reading! Subscribe to get the latest update from SentiFlow

My Reflection

To be completely transparent, SentiFlow has not added Alphabet to the portfolio. Not yet. Its Prudence Protocol—the final gatekeeper—is still weighing the position size and its fit within our broader philosophy. The system is patient.

But watching it dissect a company of this scale with such incredible nuance is exactly why I started this project. This is what we're building. Not a simple stock-picker, but an autonomous system that can connect the dots between a court ruling in D.C., the subscription habits of a teenager watching YouTube in Tokyo, and the future of autonomous taxis in Phoenix.

It’s about building a system that can think with a depth, speed, and objectivity that we humans, with all our biases and blind spots, simply can't.

This is the journey. We're building it in public, one decision at a time. If you want a front-row seat to see what happens next—and be the first to know when the SentiFlow platform is ready for you—join our inner circle.

[From: SentiFlow AI Analysis Logs]

Thanks for reading! This post is public so feel free to share it if you like it