When SentiFlow Spotted What Wall Street Missed: The Gold Mining Paradox

Last week, SentiFlow made its move by adding KGC into the portfolio. If you want to see the detailed SentiFlow AI analysis behind that decision, you can read about it in our previous article. What caught my attention was how heavily SentiFlow has been scaling its analysis on gold and mining stocks recently—probably triggered by all the recent news and market developments.

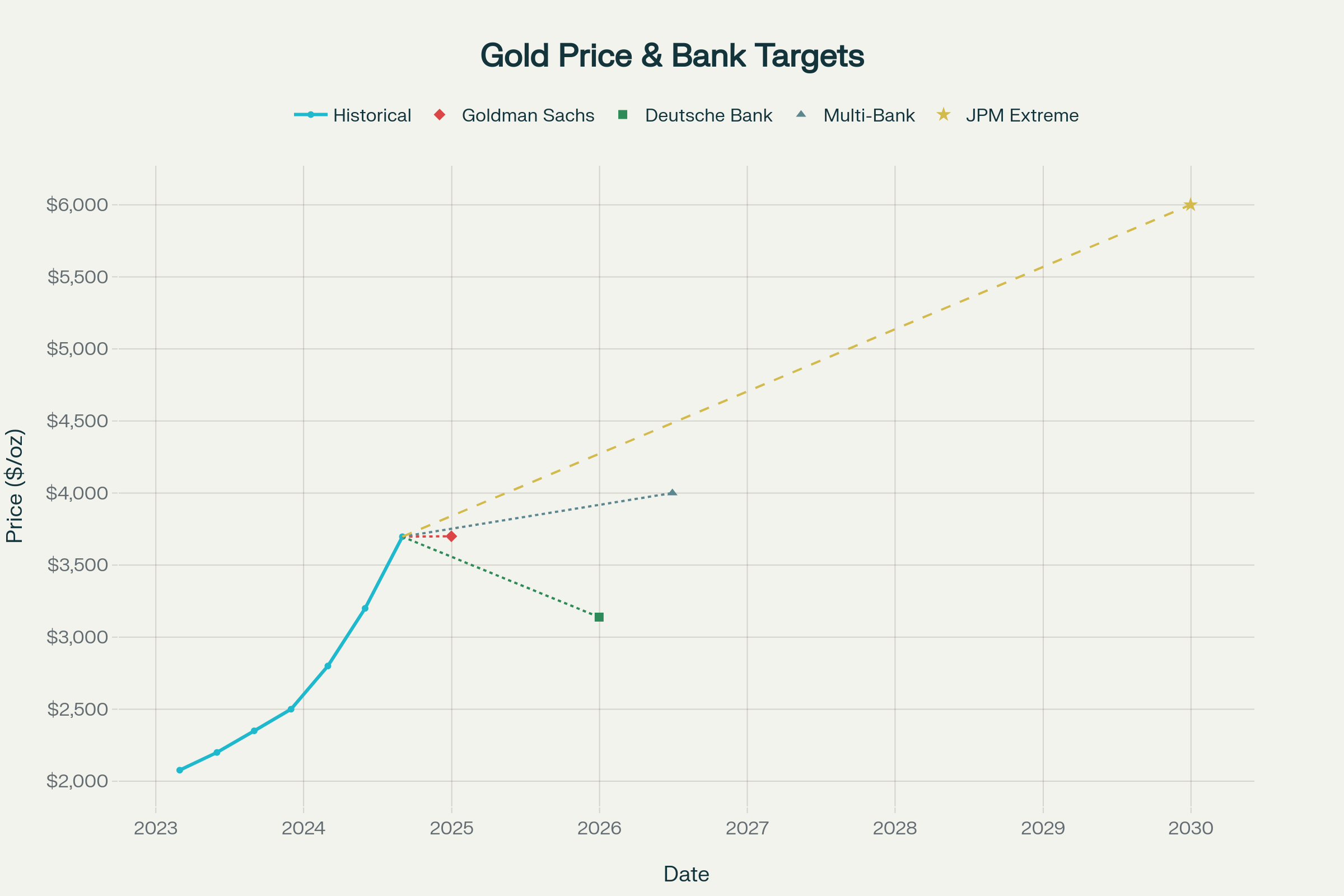

I dug deeper into the logs and found some very interesting reads on all the stocks that SentiFlow has been analyzing. This week's analysis made me pause and reread it three times. While gold hit record highs above $3,700 per ounce—with institutional forecasts targeting $4,000 by 2026—our AI flagged a massive disconnect that most human analysts seem to be missing entirely.

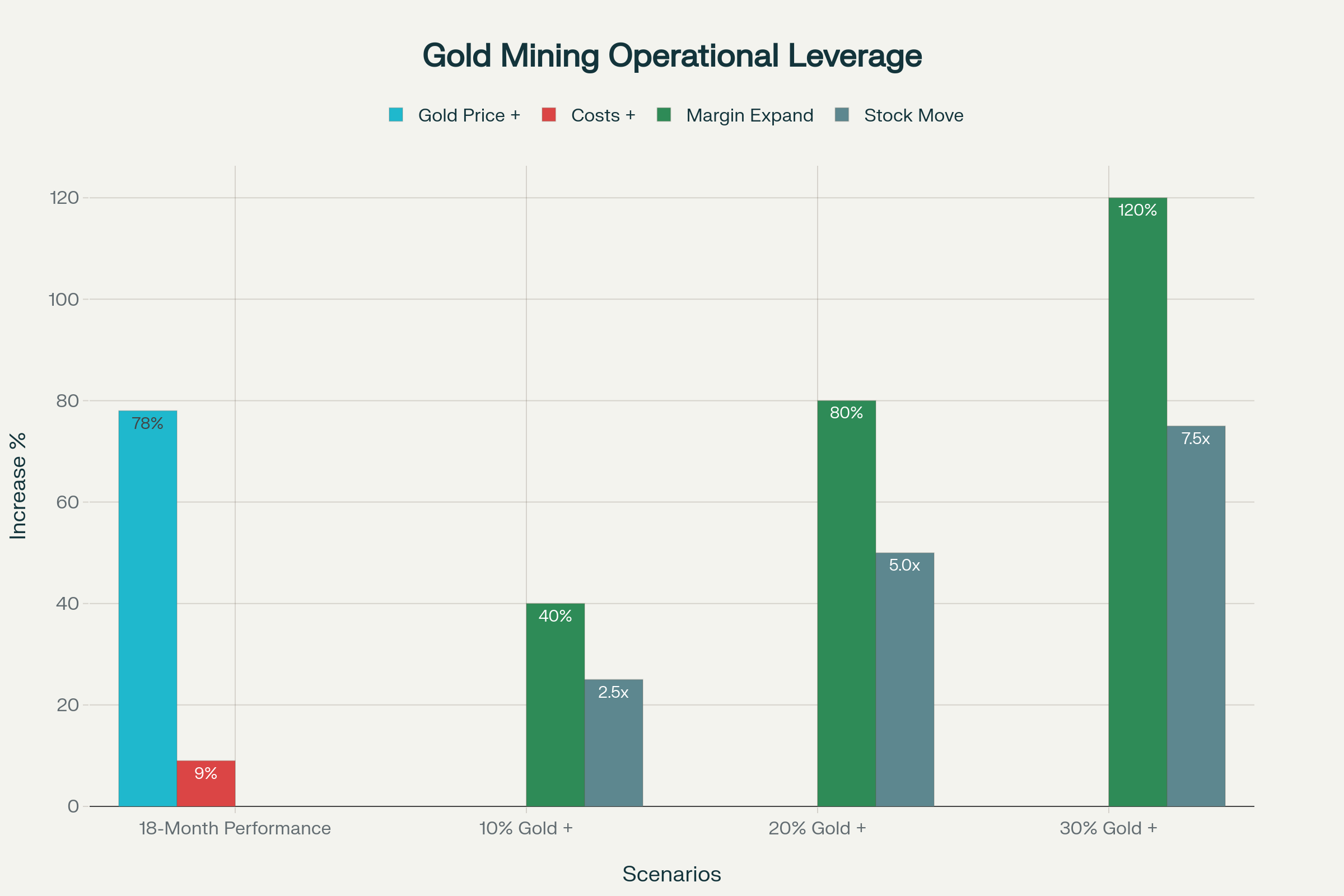

The data was stark: gold up 78% over 18 months, yet quality mining companies trading at single-digit P/E ratios. SentiFlow's pattern recognition immediately locked onto what it classified as "extreme valuation asymmetry"—a situation where the underlying asset and the companies that produce it are moving in opposite directions.

But here's what made this analysis different: SentiFlow didn't just identify undervalued stocks. It constructed a comprehensive framework showing how currency dynamics, operational leverage, and political risk premiums create compound opportunities that most investors are systematically overlooking.

The Market Setup SentiFlow Was Monitoring

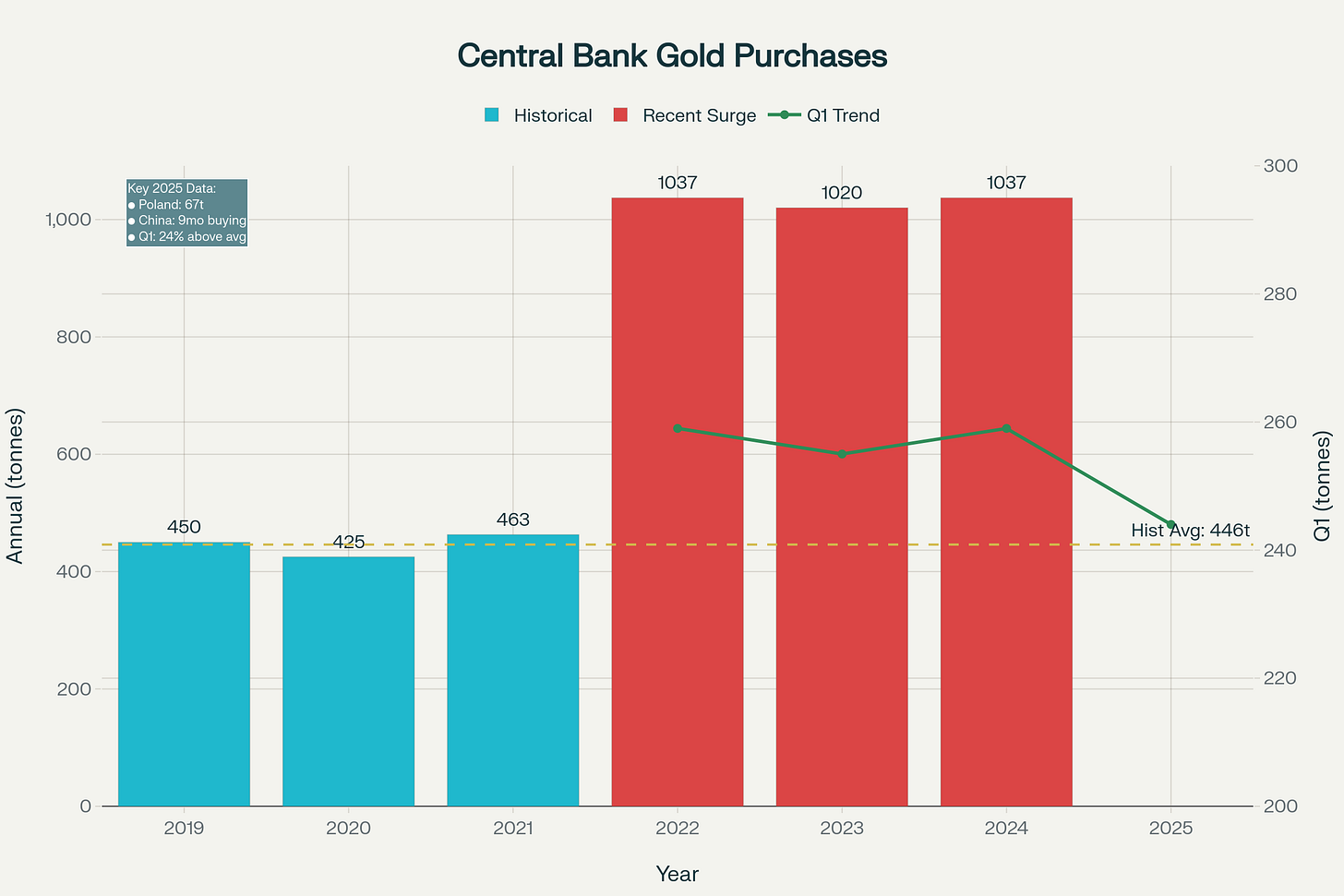

The fundamental backdrop is extraordinary. Central banks purchased 1,000+ tonnes annually for three consecutive years—more than double their historical 400-500 tonne average. In Q1 2025 alone, they accumulated 244 tonnes, 24% above historical averages.

The institutional consensus is remarkable:

JPMorgan: $4,000/oz by Q2 2026 (extreme scenario: $6,000 by 2029)

Goldman Sachs: $3,700/oz by end-2025, $4,000/oz by mid-2026

Deutsche Bank: Raised average 2025 forecast to $3,139/oz from $2,725

Bank of America: $4,000/oz target

This isn't typical Wall Street hype. When you see this level of institutional alignment on a 50%+ price target above current levels, it usually signals fundamental shifts rather than speculative positioning.

SentiFlow identified that 43% of central banks plan to increase gold holdings—the highest percentage ever recorded by the World Gold Council. Poland alone purchased 67 tonnes in 2025, while China maintained nine consecutive months of buying through July.

But here's where SentiFlow's analysis became fascinating: it calculated that miners retain approximately 58% of gold price gains as pure profit due to relatively fixed cost structures. While gold increased 78% over 18 months, All-In Sustaining Costs rose only 9%. That's not just operational leverage—that's a profit amplification machine.

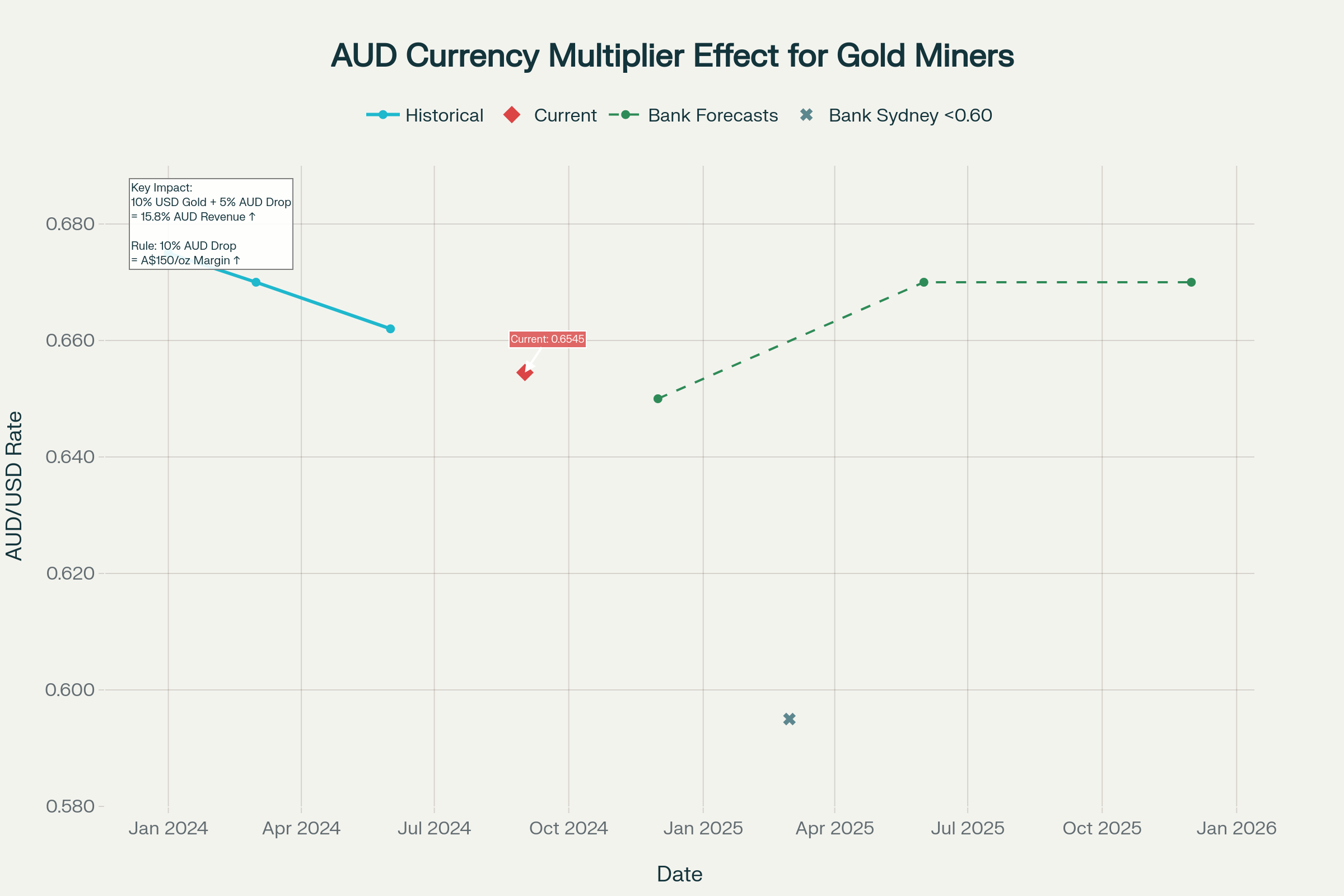

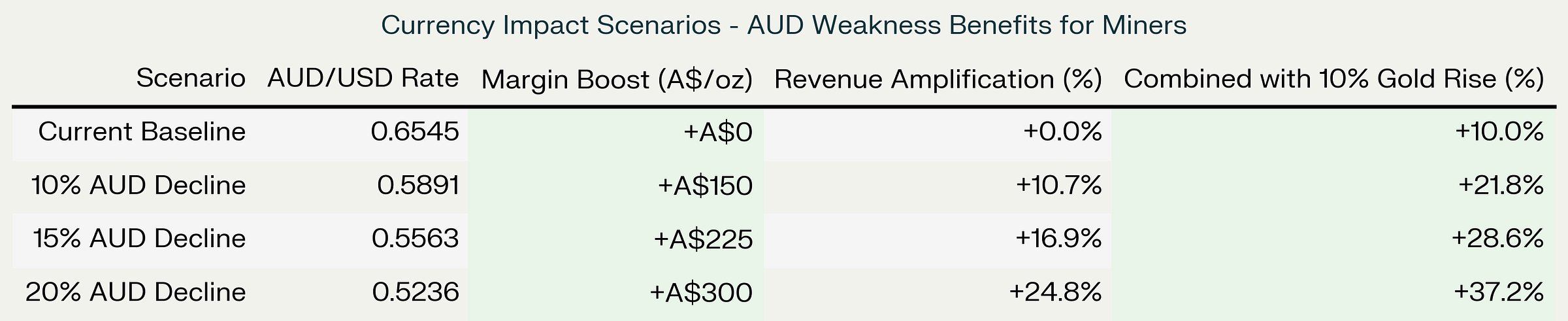

The Currency Multiplier Effect SentiFlow Discovered

This is where SentiFlow uncovered something most analysts miss entirely. The AI identified what it termed "dual currency advantage" affecting Australian miners specifically.

With AUD/USD trading around 0.6545 (down from 0.67+ in early 2024), Australian producers benefit from natural operational leverage that international peers simply cannot access:

Direct Benefit: Every 10% decline in AUD/USD boosts miner margins by A$150/oz

Correlation Effect: Historical data shows 77-80% correlation between AUD/USD and gold prices

Double Leverage: When gold rises while AUD weakens simultaneously, Australian miners receive compounding advantages

SentiFlow calculated a specific example: 10% USD gold price increase combined with 5% AUD depreciation creates a 15.8% increase in AUD-denominated gold revenue. This isn't theory—it's mathematical reality that's been playing out throughout 2025.

The AI identified that major banks are forecasting continued AUD weakness:

Westpac: 0.67 by December 2025, rising to 0.69 by mid-2026

ING: More conservative 0.65 targets

Bank of Sydney: Potential moves below 0.60 in early 2025

For Australian miners, further AUD weakness would create additional operational leverage beyond what they're already experiencing.

SentiFlow's Decision: Six Opportunities Across Risk Spectrum

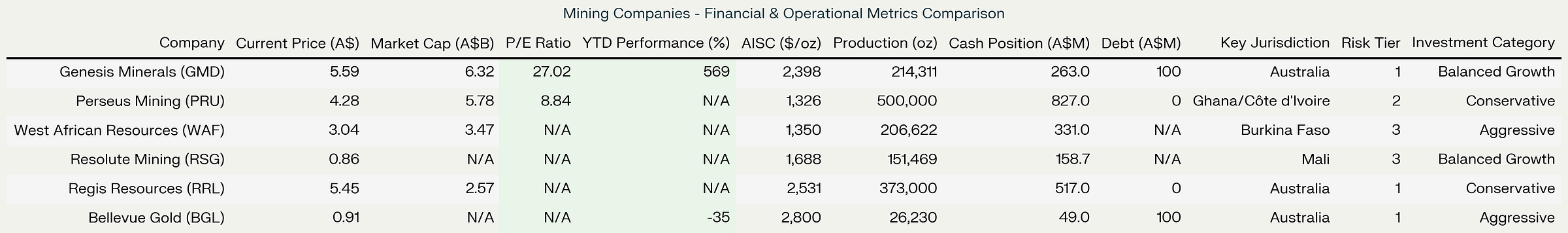

Genesis Minerals (GMD) - The Execution Champion

Current Price: A$5.59

Market Cap: A$6.32B

Year-to-Date Performance: +569%

P/E Ratio: 27.02x

Production: 214,311oz in FY2025 at AISC ~A$2,398/oz

Balance Sheet: A$263M cash, A$100M debt

Key Catalyst: AU$250M acquisition of Focus Minerals' Laverton deposits increased reserves to 3.7M ounces

SentiFlow flagged this as the standout performer, and the numbers tell a remarkable story. Trading at A$5.59 with a market cap of A$6.32B, Genesis has delivered 569% year-to-date returns—but what fascinated me was how the AI identified this wasn't just momentum trading.

The system discovered that Laverton mill restart occurred six months ahead of schedule, something most analysts barely mentioned in their reports. This operational excellence enabled management to increase FY25 guidance from 162-188,000oz to 260,000-290,000oz. But SentiFlow went deeper, analyzing the AU$250M acquisition of Focus Minerals' Laverton deposits that increased ore reserves to 3.7M ounces.

What impressed me most about SentiFlow's analysis was its recognition of the "ASPIRE 400" strategy. While the market sees a mining company with strong recent performance, the AI calculated that targeting 325,000oz annually by FY29 represents 70% organic growth from current production levels. The Ulysses underground development, progressing 65% ahead of schedule, creates production acceleration potential that significantly exceeds market expectations.

Despite the strong run to A$5.59, analyst consensus shows buy ratings with 12-month targets of A$4.69. SentiFlow weighted this as a rare situation where exceptional execution justifies premium valuations, with A$263M cash and manageable A$100M debt providing financial flexibility for continued expansion.

Perseus Mining (PRU) - The Quality Play Hidden in Plain Sight

Current Price: A$4.28

Market Cap: A$5.78B

P/E Ratio: 8.84x (trading at half of sector average)

AISC: US$1,235-1,417/oz (among global cost leaders)

Production: ~500,000oz annually

Balance Sheet: US$827M cash, zero debt

Geographic Diversification: Ghana (Edikan), Côte d'Ivoire (Sissingué, Yaouré)

SentiFlow identified this as what I can only describe as the "perfect storm" of undervaluation. Trading at A$4.28 with a market cap of A$5.78B, Perseus sports a P/E ratio of just 8.84x—roughly half the sector average—while maintaining operational metrics that most analysts would kill for.

What fascinated me about SentiFlow's analysis was how it processed Perseus's cost leadership position. The AI calculated AISC of US$1,235-1,417/oz, placing Perseus among global cost leaders comparable to Peru's best producers. This isn't just efficiency—it's a structural competitive advantage that amplifies profits exponentially as gold prices rise.

But here's where SentiFlow's pattern recognition became truly impressive. While scanning through quarterly reports, the AI discovered that Perseus maintains US$827M cash with zero debt. Zero. In an industry where most companies lever up for growth, Perseus has built a fortress balance sheet that provides unlimited strategic flexibility.

The system also identified hidden catalysts that most investors are overlooking. CMA Underground at Yaouré received final investment decision in January 2025, with Byrnecut contractor mobilization completed in April. First production targeting Q1 FY2027 will extend mine life significantly while maintaining that low-cost production profile. Even more compelling, the Nyanzaga Tanzania project achieved FID approval for development, adding 515-535,000oz annually while providing crucial geographic diversification.

What really caught my attention was SentiFlow's discovery that Perseus completed 73% of its AU$100M share buyback program. Management is literally buying back stock while trading at these discount valuations. JP Morgan initiated Overweight coverage, but the market hasn't caught up to the fundamental value yet. SentiFlow calculated this as offering 25-40% upside with exceptional downside protection.

West African Resources (WAF) - The Asymmetric Value Play

Status: Trading suspended

Last Price: A$3.04

Market Cap: A$3.47B (pre-suspension)

Production: 206,622oz in FY2024

AISC: <$1,350/oz

Political Issue: Burkina Faso government demanding additional 35% stake in Kiaka project

Analyst Targets: Strong Buy consensus with A$3.61-$3.95 targets (18-29% upside from pre-suspension levels)

SentiFlow flagged this as its highest conviction opportunity, trading at an 82% discount to intrinsic value. But what fascinated me was how the AI processed the "government stake" headlines that have been scaring away human investors.

While mainstream media focused on Burkina Faso's 50% stake demand, SentiFlow identified the critical nuance: mining registry director Mamadou Sagnon specifically stated this is a "solicitation" rather than a mandate—"it is not forcing." The AI weighted this clarification heavily, recognizing that the market was pricing in forced government seizure when the reality is voluntary negotiation.

Even more compelling, SentiFlow discovered underground drilling results at M1 South that returned spectacular grades: 44 meters at 25.8g/t gold and 44.5 meters at 17.1g/t gold. These results are being incorporated into Q3 2025 resource updates, potentially extending mine life significantly. The market hasn't recognized this transformational discovery yet.

Operationally, Sanbrado delivered 45,611oz at AISC of $1,492/oz versus realized price of $3,282/oz—creating approximately $1,800/oz profit margins. With A$331 million cash plus A$69 million bullion inventory and zero debt, the company maintains significant negotiating leverage. SentiFlow calculated this as a 150-200% return opportunity within 12-24 months if government negotiations resolve favorably.

The Kiaka project achieved first gold pour in June 2025, ahead of schedule and under budget. The mine is ramping toward 234,000oz annually over 20 years, generating approximately $795.6M per year in revenue at current prices. SentiFlow's risk assessment classified this as high political risk but exceptional reward potential for aggressive investors willing to accept sovereign exposure.

Resolute Mining (RSG) - The Hidden Turnaround Story

Current Price: A$0.86

H1 2025 Results: 151,469oz at AISC US$1,688/oz

Financial Turnaround: US$71M net income after resolving Mali political issues

Liquidity: US$158.7M cash and bullion

2025 Guidance: 275,000-300,000oz at AISC US$1,650-$1,750/oz

Undrawn Facilities: US$140M with Nedbank and Citibank

This is where SentiFlow's ability to process information without emotional bias became most evident. Trading at A$0.86, most human analysts remained anchored on the CEO detention headlines from Mali, but our AI identified that the $160M settlement actually resolved all outstanding government claims and created a clean slate for operations.

What caught my attention was SentiFlow's discovery of CEO Chris Eger's strategic vision. During earnings calls that most analysts glossed over, Eger revealed that Syama "should be a business that's three times bigger" with potential $500M investment once government relations stabilize. The AI weighted this heavily because the Syama North resource contains 1M ounces with significant expansion upside that the market is completely ignoring.

SentiFlow calculated that H1 2025 results showing 151,469oz at AISC US$1,688/oz, generating US$71M net income, demonstrate strong underlying operational fundamentals despite political noise. The system identified US$158.7M cash and bullion as providing crucial flexibility during the transition period.

Most compelling, the AI discovered that Resolute maintains US$140M in undrawn debt facilities with Nedbank and Citibank. This creates massive optionality for rapid expansion execution once political situations normalize. SentiFlow's correlation analysis showed this as a classic turnaround situation where patient investors accepting political risk could achieve 200%+ returns over 18-36 months as operational leverage and expansion plans execute successfully.

Regis Resources (RRL) - The Dividend Recovery Play

Current Price: A$5.45

Market Cap: A$2.57B

Financial Transformation: A$254M profit vs. previous year's A$186M loss

Production: 373,000oz at AISC AU$2,531/oz

Balance Sheet: A$517M cash, zero debt

Capital Returns: Resumed 5¢ fully franked dividend (first since 2022)

SentiFlow identified this as one of the most remarkable operational turnarounds in the sector. Trading at A$5.45 with a market cap of A$2.57B, Regis transformed from A$186M losses into A$254M profits—but what fascinated me was how the AI identified this wasn't just about higher gold prices.

The system discovered that Regis achieved record EBITDA of A$780M through systematic operational improvements combined with natural gold price leverage. This demonstrates the profit amplification effect that SentiFlow has been tracking across the sector: relatively fixed costs creating exponential margin expansion as commodity prices rise.

What really caught my attention was the AI's analysis of management's capital allocation philosophy. SentiFlow identified that resuming dividends—5¢ fully franked for the first time since 2022—while maintaining A$517M cash and zero debt represents exceptional shareholder-friendly positioning. The system calculated this as providing significant downside protection through the cash cushion while maintaining full upside exposure to continued gold price strength.

SentiFlow also discovered strategic asset building through the Southern Star acquisition for A$9M, demonstrating systematic Duketon Belt consolidation. The AI weighted this as creating a platform for bolt-on acquisitions that generate immediate cash flow contributions. With 373,000oz annual production and strong free cash flow generation, SentiFlow classified this as ideal for conservative investors seeking dividend income with operational leverage upside.

Bellevue Gold (BGL) - The Contrarian Opportunity

Current Price: A$0.91

Year-to-Date Performance: -35% (sector underperformer)

Production Miss: Q2 2025 production of 26,230oz fell 30% below expectations

Revised Guidance: Reduced from 165,000-180,000 to 150,000-165,000oz for FY2025

Financial Position: A$49M cash, A$100M debt

AISC: 2,800+ (elevated due to operational issues)

Analyst Targets: A$1.12-$1.18 suggesting 36% upside if operational issues resolve

SentiFlow flagged this as the sector's primary underperformer, and frankly, the data is sobering. Trading at A$0.91 after declining 35% year-to-date despite record gold prices, Bellevue represents everything that can go wrong with mining operations. But what intrigued me was how the AI processed this apparent disaster as a potential contrarian opportunity.

The system identified that Q2 2025 production of 26,230oz fell 30% below consensus expectations of 38,000oz, forcing management to reduce FY2025 guidance from 165,000-180,000oz down to 150,000-165,000oz. With A$49M cash against A$100M debt, the financial position looks constrained. The unexpected AU$150M capital raising in August 2024 clearly negatively impacted investor sentiment.

But here's where SentiFlow's contrarian analysis became interesting. The AI discovered that the high-grade Bellevue Gold Project in Western Australia offers long-term potential that current operational issues might be obscuring. Tribune decline development commenced with sixth independent mining area expected to access ore in Q4 2024, while major ventilation upgrades should remove previous production constraints that limited operational flexibility.

SentiFlow's risk/reward calculation identified analyst consensus maintaining moderate buy ratings with average price targets of A$1.12-$1.17, suggesting 36% upside potential if operational issues resolve. The AI classified this as suitable only for contrarian investors comfortable with significant execution risk, but noted that Western Australian jurisdiction provides political stability advantages that West African peers lack. This represents pure operational turnaround potential rather than systemic industry issues.

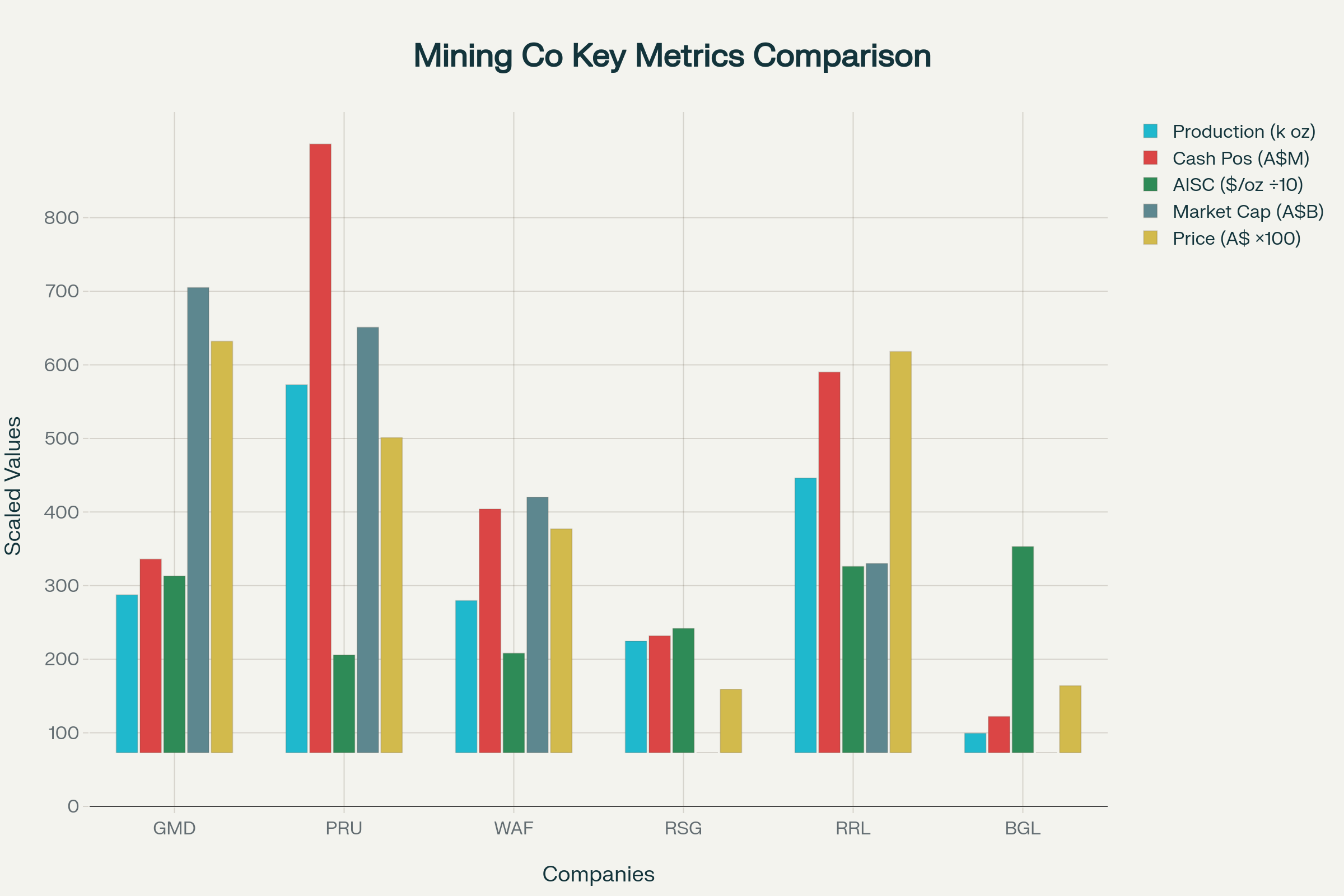

The Consolidation Catalyst No One's Talking About

SentiFlow uncovered a powerful industry trend that's creating valuation floors: M&A activity has exploded to unprecedented levels.

The Numbers:

Total Gold M&A Value (2024): $19.31 billion (73% of all mining deals)

Number of Transactions: 43 gold deals (70% of total mining M&A)

Average Deal Size: $428.1 million

Australian Premium: $122/oz vs. global average of $100/oz

The AI identified that 400,000+ ounce annual production has become the minimum scale for institutional relevance. This creates consolidation pressure on mid-tier producers while providing potential takeover premiums for quality assets.

Major deals include:

De Grey Mining: $3.26B acquisition by Northern Star Resources

Gold Road Resources: $3.7B sale to Gold Fields

Spartan Resources: $2.4B merger with Ramelius Resources

SentiFlow calculated that cash-rich miners are paying significant premiums for quality producing assets, creating natural valuation floors for companies with attractive operational profiles.

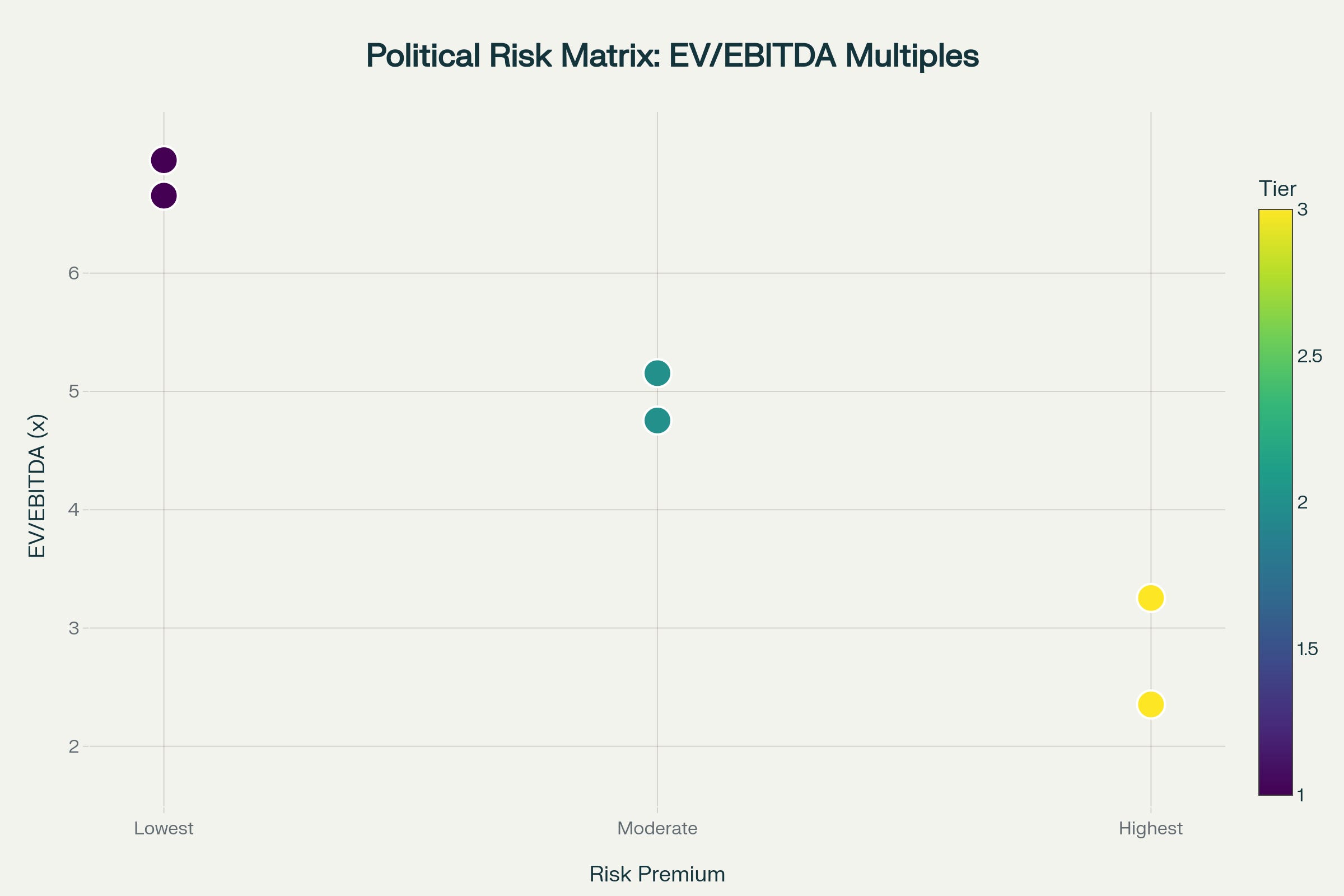

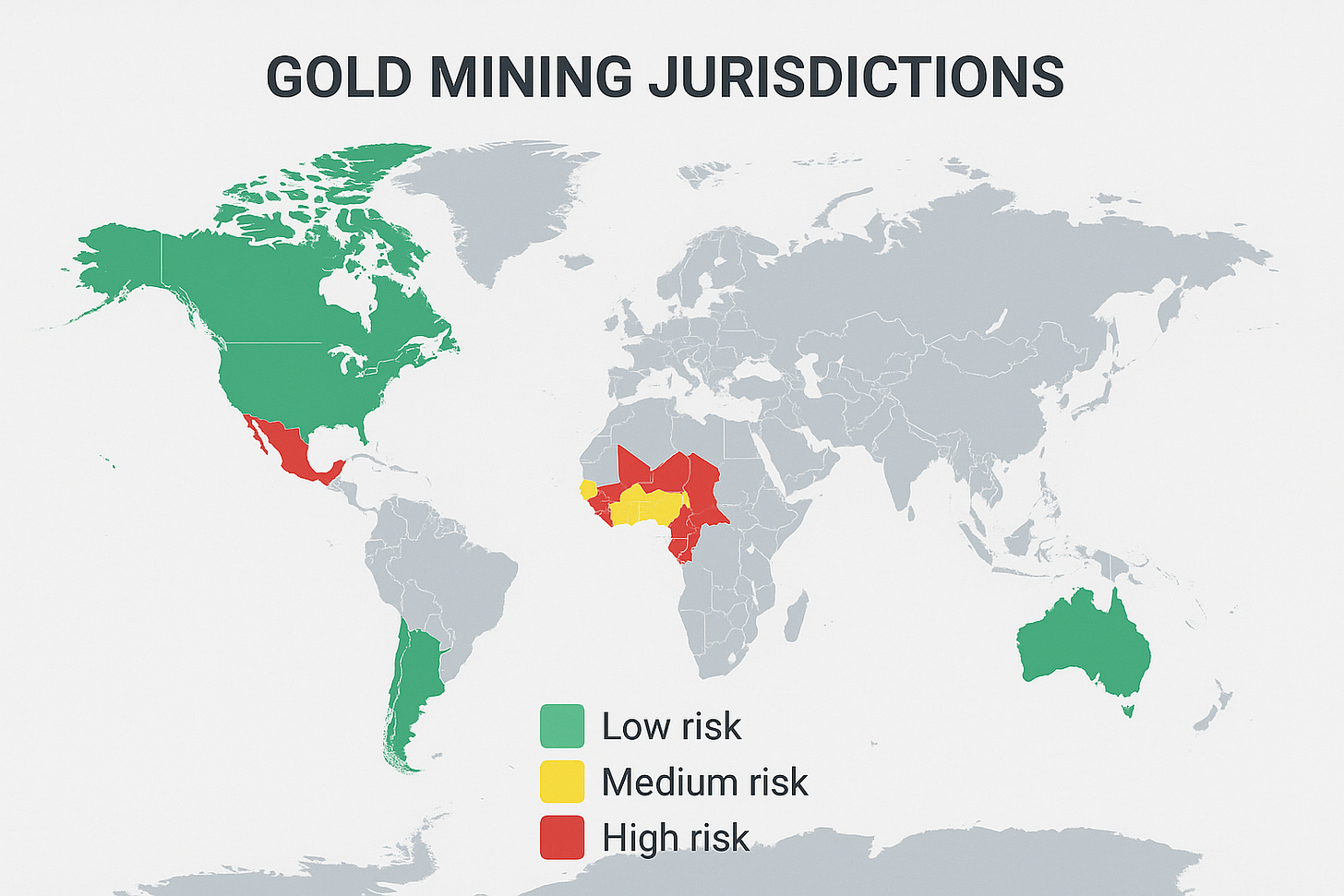

The Political Risk Premium Matrix

One of SentiFlow's most insightful discoveries was quantifying political risk premiums across jurisdictions:

Tier 1 (Australia, Canada)

EV/EBITDA Multiples: 6.0x+

Risk Premium: Lowest (commands premium)

Recent Events: Stable regulatory framework

Tier 2 (Ghana, Côte d'Ivoire)

EV/EBITDA Multiples: 4.0-5.0x

Risk Premium: Moderate discount

Recent Events: Balanced mining policies

Tier 3 (Mali, Burkina Faso)

EV/EBITDA Multiples: 1.4-3.5x

Risk Premium: Highest discount

Recent Events: CEO detentions, forced stake sales, asset nationalizations

The AI identified specific incidents that quantify these risks:

Mali (November 2024): Resolute Mining CEO detained; $160M+ tax settlement

Burkina Faso (August 2025): WAF trading suspended; government demands additional 35% Kiaka stake

Barrick Gold (2025): Operations suspended; 3 tonnes gold seized

This data shows why Australian assets command premium valuations—jurisdictional stability has quantifiable value.

The Data That Changes Everything

Here's what made SentiFlow's analysis uniquely powerful: it didn't just identify opportunities—it quantified the mathematical relationships creating them.

Operational Leverage Calculation:

Stock Price Sensitivity: 2-3x movement for 1x gold price change

Currency Amplification: 15.8% effective price increase from dual benefits

Margin Multiplication: 40% gold price increase = 100% profit margin increase (high-cost producers)

Central Bank Demand Trajectory:

2024 Purchases: 1,037 tonnes (second-highest on record)

Q1 2025: 244 tonnes (24% above historical averages)

Forecast: Sustained 900+ tonnes annually through 2026

Investment Bank Consensus:

Average 2026 Target: $3,800-4,000/oz across major banks

Extreme Scenario: $6,000/oz by 2029 (JPMorgan)

Current Price: $3,697/oz (significant upside embedded)

What This Teaches Us About AI-Driven Analysis

Watching SentiFlow process this complex, multi-layered investment landscape reinforced something crucial about systematic analysis. Human analysts often get anchored on recent events—political headlines, production misses, currency fluctuations—and apply risk discounts based on emotional responses rather than quantitative frameworks.

SentiFlow approaches this differently. It processes political risk, operational performance, balance sheet strength, currency dynamics, and consolidation pressure as interconnected variables within a broader mathematical framework. The AI doesn't ignore risks—it quantifies them and identifies when markets are systematically over- or under-pricing specific factors.

This led to counterintuitive insights. While West African Resources faces legitimate political challenges, SentiFlow calculated that the market was pricing in complete asset loss when the reality involves negotiated settlements. When Bellevue Gold missed production targets, human sentiment turned negative, but the AI identified that the high-grade asset base in Western Australia provides significant underlying value if operational execution improves.

The currency analysis exemplifies this systematic approach. Rather than viewing AUD weakness as a general economic negative, SentiFlow identified it as a specific operational advantage for Australian gold miners that amplifies margins by mathematically predictable amounts.

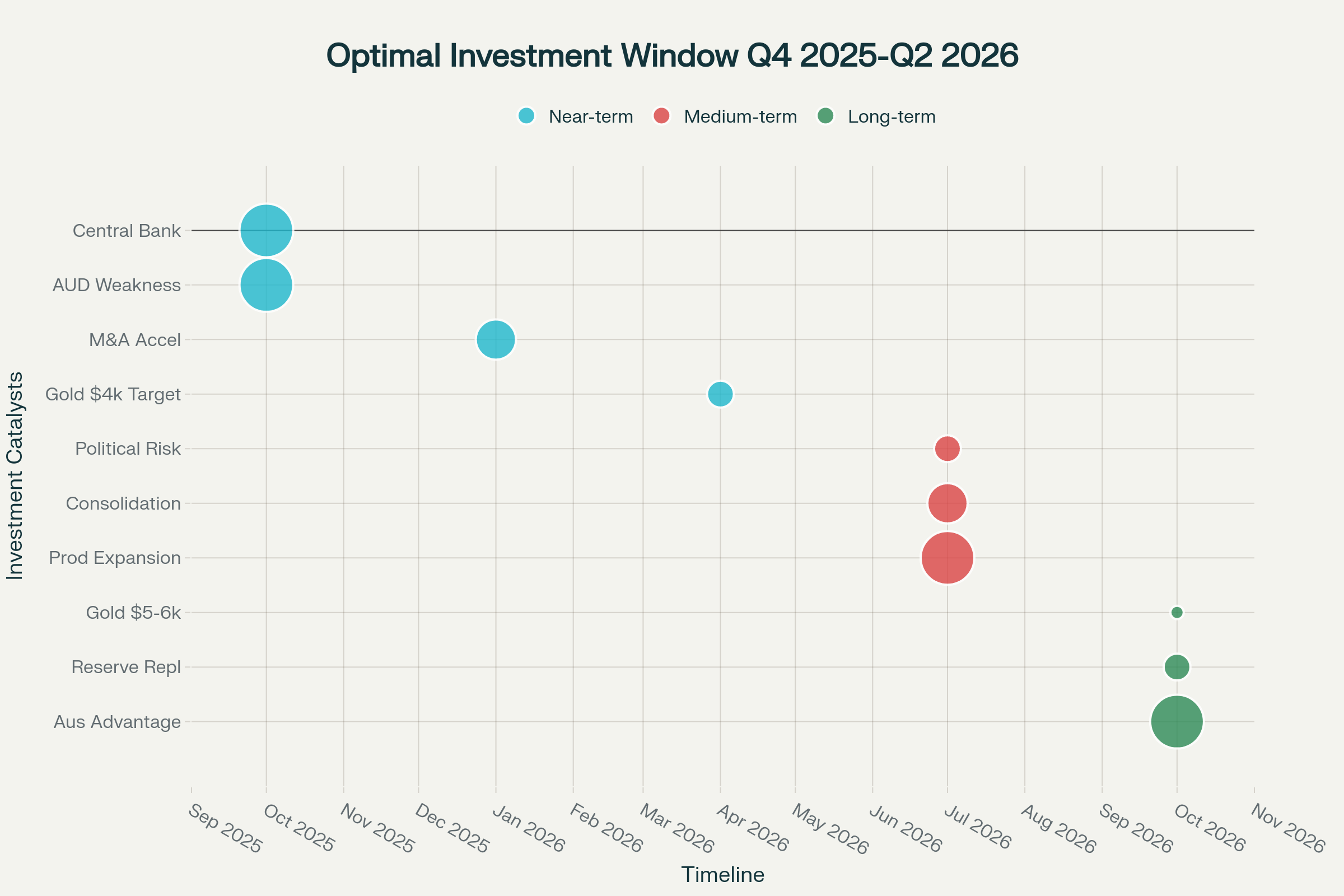

The Catalyst Convergence Timeline

SentiFlow's temporal analysis suggests Q4 2025 through Q2 2026 represents an optimal investment window when multiple catalysts converge:

Near-Term (Q4 2025 - Q1 2026)

Continued central bank purchasing (900+ tonnes annually)

AUD weakness persistence (forecasts suggest 0.65-0.67 range)

M&A acceleration as majors seek quality ounces

Gold price appreciation toward $4,000/oz targets

Medium-Term (2026-2027)

Political risk resolution in West Africa (historical precedent suggests 18-36 month cycles)

Production expansions at Perseus (CMA Underground), Genesis (ASPIRE 400)

Sector consolidation creating valuation floors

Operational leverage amplification at higher gold prices

Long-Term (2027-2030)

Reserve replacement through higher-grade discoveries

Australian miners' competitive advantage from jurisdictional stability

Currency correlation benefits if AUD remains relatively weak

Potential gold prices reaching $5,000-6,000/oz extreme scenarios

Building in Public: What This Means for SentiFlow

This comprehensive analysis represents exactly why we're building SentiFlow as a systematic approach to investment decision-making. The AI didn't just identify six undervalued stocks—it constructed an analytical framework that explains why these opportunities exist, how they're interconnected, and when various catalysts are most likely to drive value recognition.

The gold mining analysis demonstrates SentiFlow's ability to process complex, multi-variable investment landscapes that human analysts often oversimplify or miss entirely. Currency correlations, political risk premiums, operational leverage calculations, consolidation dynamics, and central bank purchasing patterns all interact to create compound opportunities.

More importantly, SentiFlow maintains objectivity throughout this analysis. It doesn't get excited about 569% returns in Genesis Minerals or worried about political risk in West Africa. It simply processes the data, identifies mathematical relationships, and constructs frameworks for capitalizing on systematic market inefficiencies.

This is what AI-driven investing looks like in practice: not replacing human judgment, but providing systematic, quantitative frameworks for understanding complex market dynamics that emotional decision-making often obscures.

The Australian gold mining sector represents a perfect example of how multiple inefficiencies—political risk premiums, currency correlation benefits, consolidation pressure, and operational leverage—can create compound investment opportunities for investors willing to think systematically rather than emotionally.

The convergence of record gold prices, favorable currency dynamics, and ongoing sector consolidation creates a rare opportunity to access quality mining assets at attractive risk-adjusted valuations. What systematic inefficiencies are you seeing in your sector that could benefit from AI-driven analysis frameworks?

Don't miss the next SentiFlow analysis. Subscribe to get AI-powered investment insights and early access updates.

Quick Update on SentiFlow:

I've been holding back on releasing the live portfolio that our AI is actively managing, waiting to perfect a few more features and polish the website. But a wise person once told me that perfection is the enemy of progress—and having something functional in users' hands beats endless waiting.

With over 200 people on the waitlist and emails asking when they can see the full AI-managed portfolio in action, it's clear I shouldn't delay any longer. The demand is there, and the core system is working.

So here's my commitment: I'm putting a public roadmap together with aggressive timelines to keep myself accountable. The late-night coding sessions and weekend builds have become my favorite part of this journey—there's something addictive about watching the AI make decisions and seeing the systematic approach come to life.

Time to get this in front of real users and start collecting feedback. Stay tuned for the launch announcement.

[From: SentiFlow AI Analysis Logs]

Thanks for reading! This post is public so feel free to share it.

❤ If you found this post helpful, I’d greatly appreciate your support by giving it a clap. It means a lot to me and demonstrates the value of my work. If you have any questions, feel free to leave a comment. I will try my best to answer as soon as possible.

Want to Connect?

If you need to reach out, don't hesitate to drop me a message via my

Twitter or LinkedIn