Weekly Briefing: The Tech Stock Our AI Thinks Is Mismarked

Welcome to the SentiFlow AI weekly briefing, where we give you a look inside the mind of our AI-driven hedge fund.

Our system is designed to be patient and data-driven. SentiFlowAI flagged this massive opportunity on 5th of August and make the trading on the next day after verifying the data and waiting for a clear market signal before the Portfolio Manager agent initiated a trade

Our four agents—the Data Scout, Analyst, Risk Manager, and Portfolio Manager—work 24/7 to find signals in the noise of the market. Last few weeks, they locked onto a fascinating story: a technology company that’s firing on all cylinders, just made a game-changing move, and yet, still seems to be sitting on the discount rack.

This Substack is reader-supported. To receive new posts and support my work, consider becoming a free or paid subscriber.

Let’s break down what our AI saw in CommScope (Ticker: COMM).

The Signal: What Our Data Scout Agent Found

It all started when our Data Scout Agent flagged two massive alerts on CommScope, a company that builds the essential plumbing of the internet—fiber optic cables, wireless gear, and networking equipment.

A Blockbuster Deal: News broke that COMM had agreed to sell one of its divisions for a staggering $10.5 billion in cash. The stock surged 80% on the day of the announcement. A move that large is a signal so loud, it’s impossible to ignore.

Explosive Earnings: Almost simultaneously, the company reported its Q2 2025 earnings. Revenue was up a massive 32% from the previous year, with some divisions growing even faster.

A huge corporate deal plus rocketing growth? The Data Scout immediately passed this to our Analyst Agent to figure out the story behind the numbers.

The Analysis: Why Our Analyst Agent Is So Intrigued

Our Analyst Agent took the raw data and pieced together a powerful investment thesis. It found three key things that make CommScope a compelling case.

1. Pay off all of its debt

CommScope has historically carried a lot of debt, which often makes investors nervous. This $10.5 billion sale is a silver bullet for that problem. The company’s CEO stated the plan is to use the cash to pay off all of its debt, with billions left over.

Think of it this way: Imagine you have a huge mortgage hanging over your head. Now, imagine selling your garage for enough money to pay off the entire mortgage and still have enough cash left to fund your dreams for years to come. That’s the kind of financial transformation we’re talking about. It fundamentally changes the health and stability of the company overnight.

2. The High-Growth Engine Left Behind

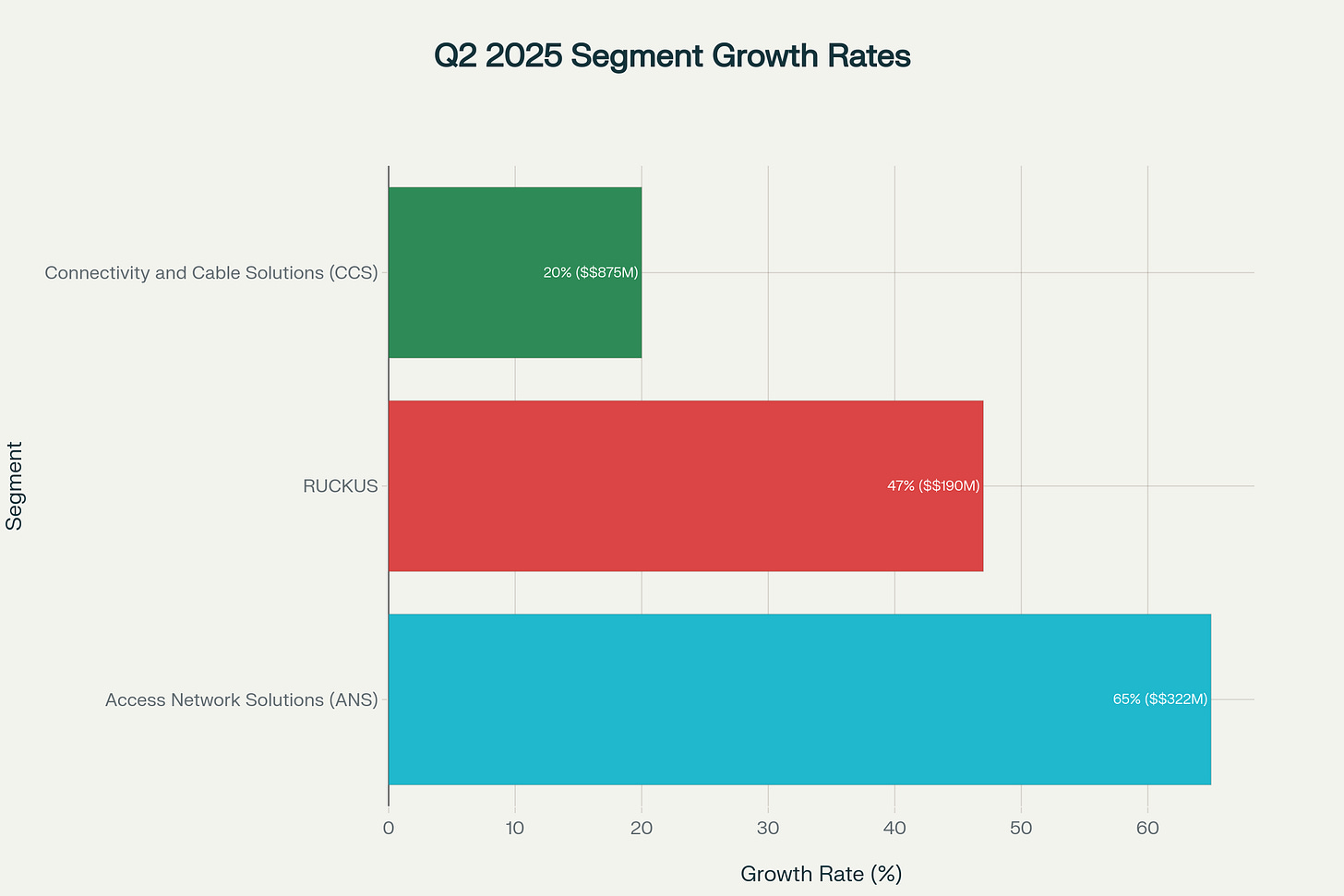

Usually, when a company sells a big division, you worry about what's left. The Analyst Agent dug into the remaining businesses and found the opposite. The parts of CommScope that aren't being sold are the ones growing the fastest:

Access Network Solutions (ANS): This segment, which helps deliver next-generation broadband, grew by a staggering 65%. This was driven by record demand for its DOCSIS 4.0 products as cable companies upgrade their networks.

RUCKUS: This segment, which provides advanced Wi-Fi solutions for businesses, grew by 47%, fueled by strong demand for new Wi-Fi 7 technology.

This isn't a company selling its crown jewel to survive. It’s selling a valuable asset to unlock an even faster-growing, more focused technology business perfectly aligned with major tech trends like 5G and AI infrastructure.

3. The Valuation Paradox

Here’s the part that really got our AI’s attention.

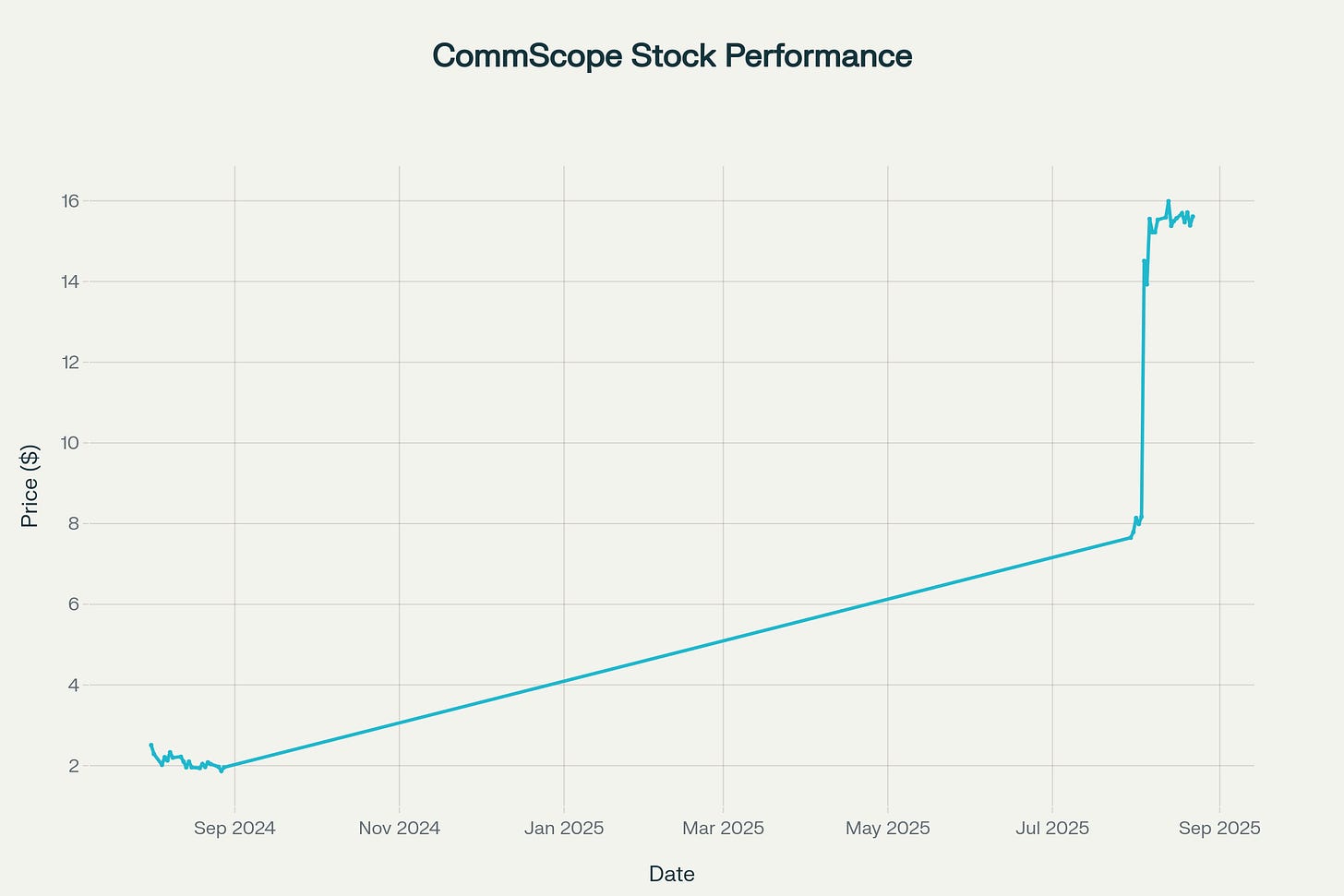

Even after the stock jumped over 300% in the last year, historical price data confirms a 521.9% year-over-year increase, from $2.51 in August 2024 to $15.61 in August 2025. The stock's journey from a 52-week low of $1.93 in August 2024 to a high of $16.12 in August 2025 represents a 735.2% peak gain, demonstrating the magnitude of the company's strategic transformation and market revaluation.

The Analyst Agent’s valuation models show it’s still remarkably cheap. Its Price-to-Sales (P/S) ratio, a common way to value a company, is trading at a 79% discount compared to other companies in its sector.

This is a classic market anomaly. It’s like discovering a sports car with a brand-new rocket engine that is somehow being sold for the price of a used sedan. The market seems to have priced in the growth, but not the new, debt-free reality and the deep value that remains.

The Reality Check: How Our Risk Agent Stress-Tested the Idea

Of course, no investment is a sure thing. Our Risk Management Agent is designed to be the internal skeptic, and it immediately ran a battery of stress tests on the Analyst’s thesis:

Execution Risk: Can the company manage such a massive sale without a hitch? Big corporate deals can be complex and messy.

Competition: The growth in the Wi-Fi and Broadband divisions is incredible, but it’s a competitive field. Can they keep it up?

Economic Headwinds: If the economy slows down, will businesses and telecom giants pull back on their spending for network upgrades?

The Risk Agent flagged these as factors to monitor closely. However, it concluded that the potential reward from the financial transformation and sustained growth currently outweighs these manageable risks.

The Verdict: The Portfolio Manager's Move

Finally, our Portfolio Manager (PM) Agent synthesized all the inputs.

It saw the powerful, data-driven signals from the Scout. It agreed with the Analyst's compelling thesis about debt elimination, core growth, and deep value. And it acknowledged the calculated risks from the Risk Manager.

The verdict? The combination is too powerful to ignore. The PM Agent has concluded that CommScope (COMM) represents a rare opportunity and has initiated a position in the SentiFlow model portfolio.

We’ll be monitoring this one closely. Stay tuned for updates, and we’ll be back next week with another look inside our AI’s brain.

[From: SentiFlow AI Analysis Logs]

Disclaimer: This is not financial advice. This article reflects the analysis and model portfolio decisions of the SentiFlow AI system. All investment decisions should be made with the help of a professional and based on your own research and risk tolerance.

SentiFlow AI is in development and will be launching soon. Subscribe to receive company updates and our AI-powered stock picks.