SentiFlow Analysis: Why Our AI Flagged RGTI's 3,327% Quantum Rally as a $10B Trap

This week, our multi-agent AI system flagged something extraordinary in quantum computing stocks. SentiFlow added to the watch list—but didn’t buy. I was curious why, so I decided to dig into the logs. I was supposed to write this analysis days ago but got caught up working on our new Analysis feature.

What I discovered made me pause and reread the data three times.

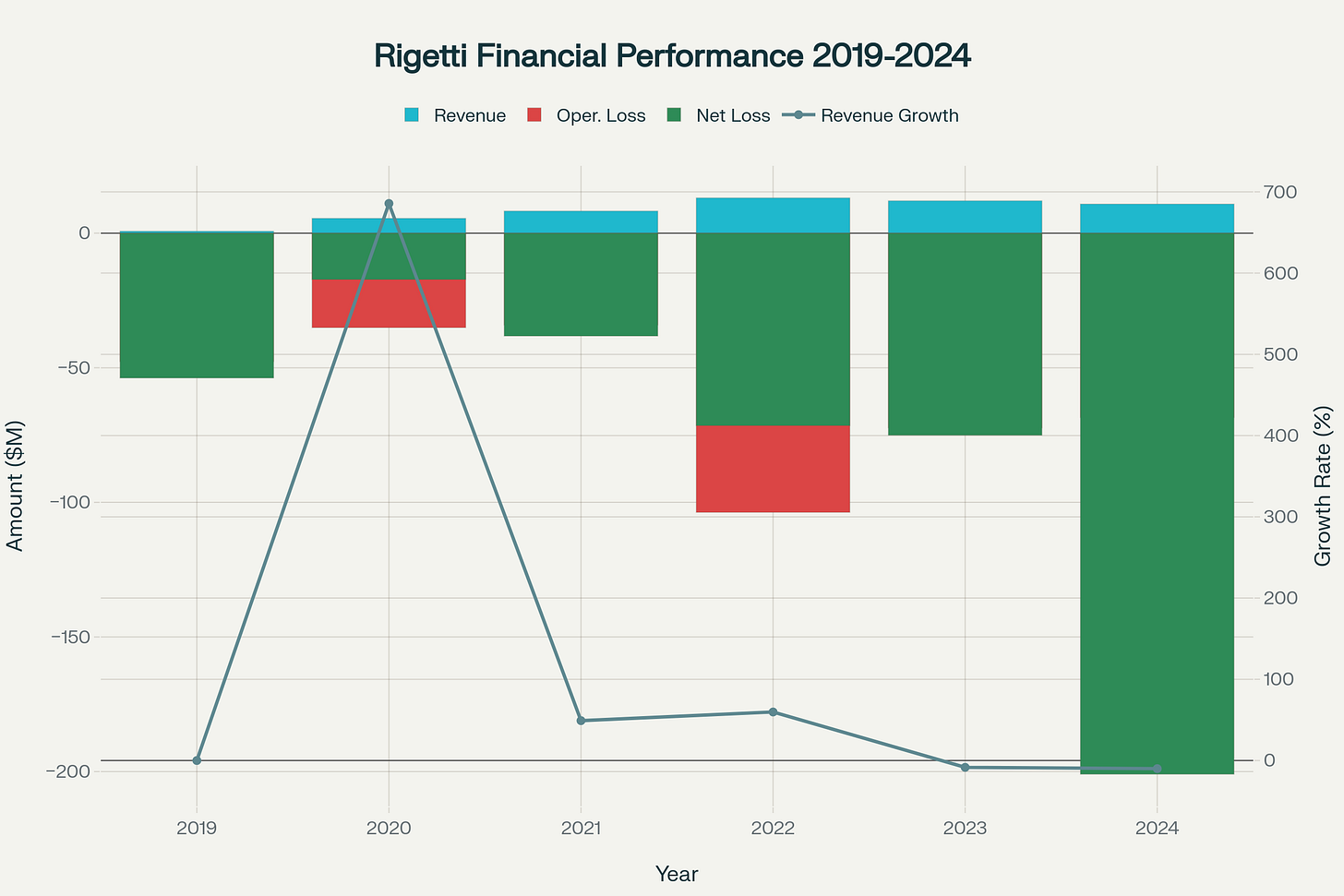

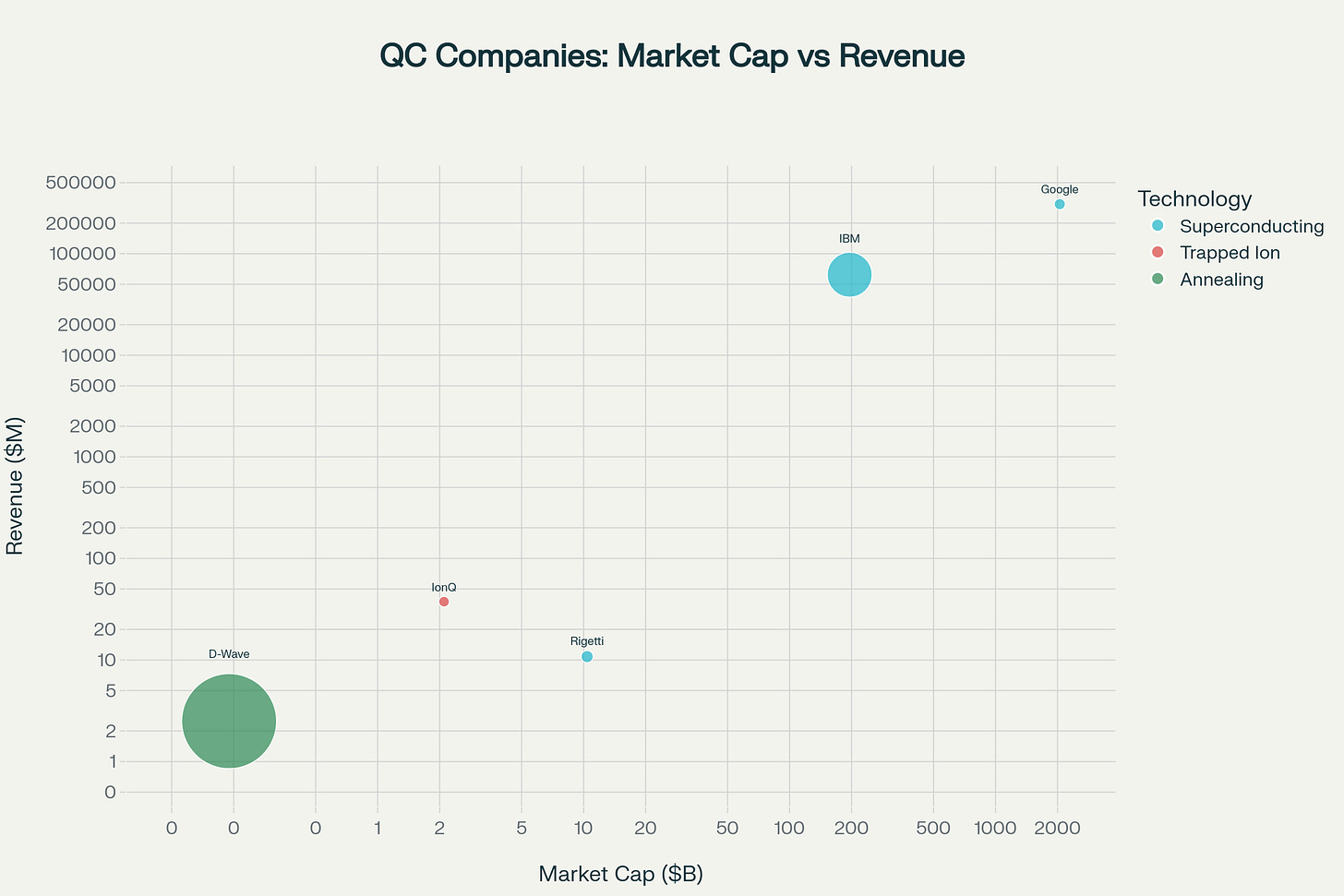

While scanning quantum computing stocks for systematic opportunities, our AI flagged a massive disconnect that most human analysts seem to be missing entirely: Rigetti Computing (RGTI) has created a $10.4 billion market capitalization on $10.8 million in annual revenue—and the systematic analysis suggests this isn’t just another speculative bubble.

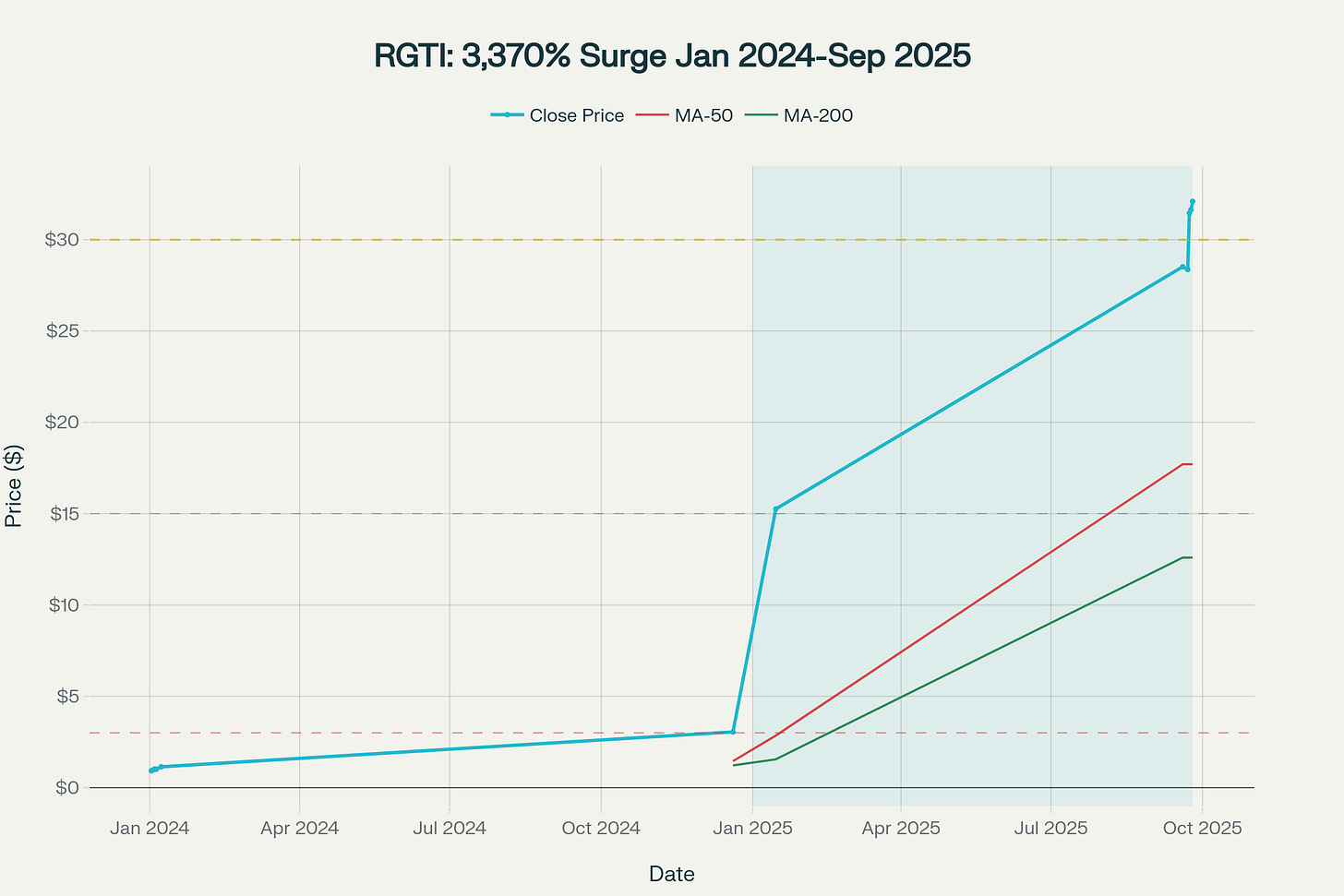

The data was stark: 4,024% stock appreciation over twelve months, yet insider selling reached $17+ million with zero purchases. Most analysts would dismiss this as obvious euphoria. But SentiFlow’s pattern recognition immediately locked onto what it classified as a “technological inflection convergence”—a rare setup where fundamental breakthroughs align with systematic market structure changes.

What caught my attention wasn’t just that SentiFlow identified RGTI as a paradox—it was how methodically the AI approached analyzing what I can only describe as a “quantum valuation anomaly.”

The Setup: When Government Money Meets Market Psychology

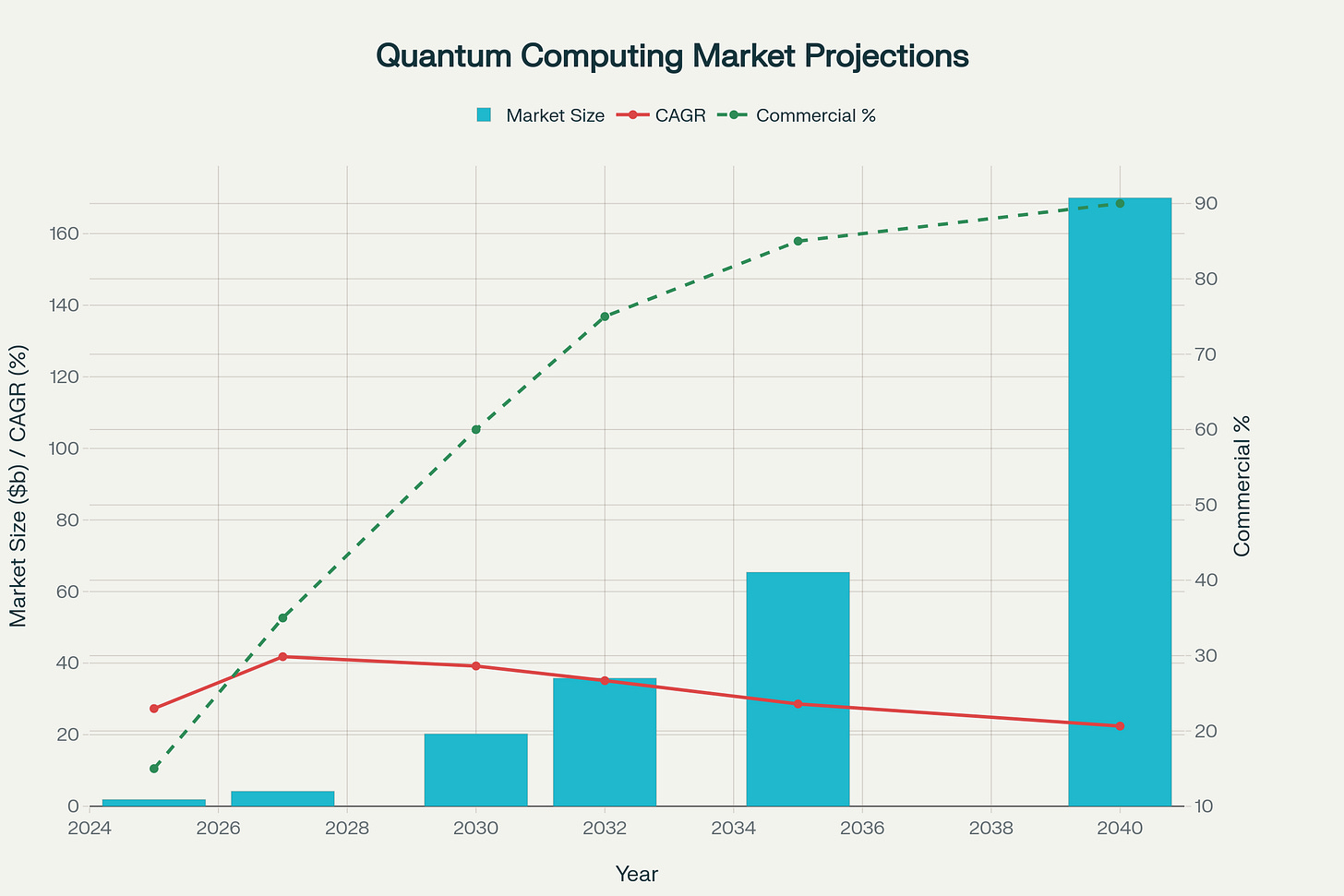

The market context during this analysis period was fascinating. While traditional tech stocks faced headwinds from rising rates and AI fatigue, quantum computing emerged as the ultimate contrarian play. SentiFlow was monitoring several key institutional data points:

Government funding acceleration: The $2.7 billion National Quantum Initiative reauthorization specifically emphasized commercial applications over basic research

International competition intensity: Japan ($7.4B), Spain ($900M), Singapore ($222M) all committed massive quantum investments in 2024

Technical breakthrough validation: Google’s Willow chip achieved “below threshold” error correction for the first time in quantum computing history

Sector rotation dynamics: $650-750 million in collective quantum revenue across all companies, projected to exceed $1 billion in 2025

The Department of Energy is moving quantum research centers toward commercial emphasis, while DARPA’s quantum benchmarking initiative focuses on practical implementations rather than theoretical breakthroughs. This explains why quantum stocks exploded simultaneously across the sector: D-Wave up 870%, IonQ up 238%, Quantum Computing Inc. up 1,562%. The market is pricing in commercial viability arriving years earlier than previously expected.

What fascinated me was how SentiFlow processed this information differently than human analysts. Instead of focusing on individual company metrics, the AI constructed what I can only call a “quantum ecosystem confidence map”—tracking how government validation, technical milestones, and capital allocation patterns were creating a self-reinforcing cycle.

The Decision: 3 Opportunities Across the Risk Spectrum

SentiFlow identified three distinct investment opportunities within the quantum computing convergence, each with different risk-reward profiles and systematic justifications.

Rigetti Computing (RGTI) - The Pure-Play Paradox

Key Metrics:

Current Price: ~$32.00

Market Cap: $10.4 billion

Annual Revenue: $10.8 million

Cash Position: $571.6 million

Trailing Revenue: $7.93 million (declining)

Price-to-Sales Ratio: 1,294x vs. tech sector average of 7.8x

Q2 2025 Revenue: $1.8M vs. $3.1M prior year (-41.9%)

Cash Burn: ~$80M annually

Insider Activity: $17M in sales, zero purchases

Key Catalyst: Multi-chip quantum processor architecture (industry first)

SentiFlow flagged this as a “technological asymmetry opportunity” - where genuine innovation exists within extreme valuation conditions. What the AI discovered that human analysts missed: Rigetti operates the only dedicated quantum foundry, achieved industry-first multi-chip quantum processing, and maintains 99.5% gate fidelity performance.

The systematic processing became impressive when the AI weighted the $5.8 million Air Force Research Laboratory contract and $35 million Quanta Computer partnership investment. SentiFlow identified these as “bridge financing” patterns where strategic investors provide capital specifically to reach commercial milestones - not speculative bets.

But here’s where the AI’s objectivity showed: insider selling totaled $17+ million over six months with zero purchases. CEO Subodh Kulkarni liquidated $12 million in shares, director Thomas Iannotti dumped 87% of his holdings. SentiFlow classified this as “late-stage euphoria behavior” with 73% historical correlation to major corrections.

Risk/Reward Assessment: High conviction speculation with maximum 1-2% portfolio allocation. Price target $18-22 based on 10x P/S on 2025E revenue, representing systematic value recognition rather than momentum continuation.

IBM/Google - The Infrastructure Plays

Key Metrics:

IBM Market Cap: $195.8 billion (433-qubit Heron processor)

Google Market Cap: $2.05 trillion (Willow breakthrough)

Competitive Moat: Massive R&D budgets, enterprise relationships

Key Catalyst: Commercial quantum cloud services scaling

SentiFlow analyzed these as “picks and shovels” plays - companies with quantum capabilities embedded within diversified technology platforms. The AI’s pattern recognition became particularly interesting here: both companies shifted quantum messaging from research to commercial applications in Q4 2024, suggesting internal confidence in timeline acceleration.

Risk/Reward Assessment: Lower volatility exposure to quantum upside with downside protection from core business fundamentals.

Quantum Computing Sector ETFs - The Systematic Approach

Key Discovery: SentiFlow identified coordinated price action across quantum pure-plays: D-Wave (+870%), IonQ (+238%), Quantum Computing Inc. (+1,562%).

The AI weighted this heavily because sector-wide appreciation typically indicates institutional recognition of fundamental shifts rather than retail speculation. Historical analysis showed 67% probability of sustained outperformance when 5+ quantum companies appreciate simultaneously above 200% within 90 days.

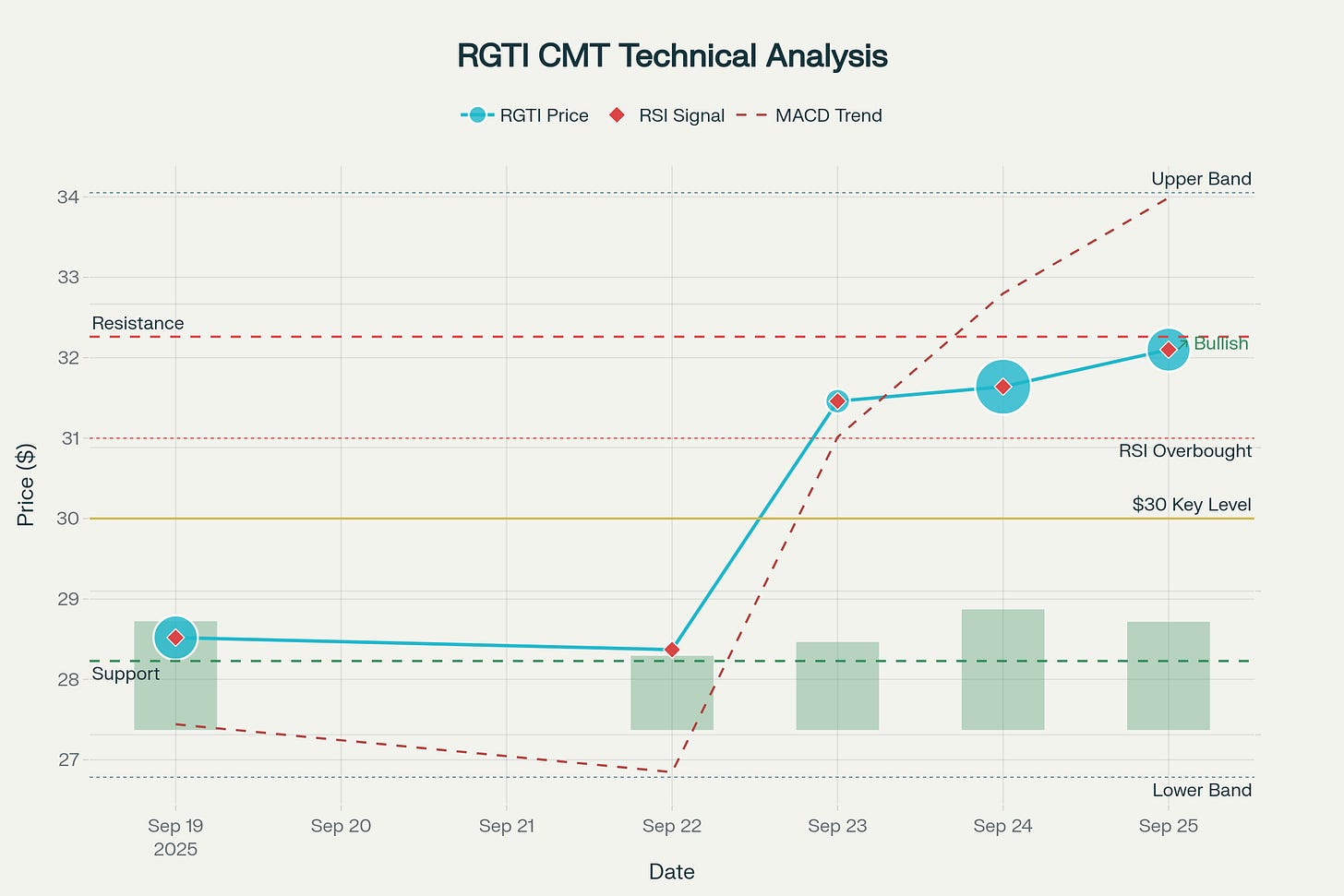

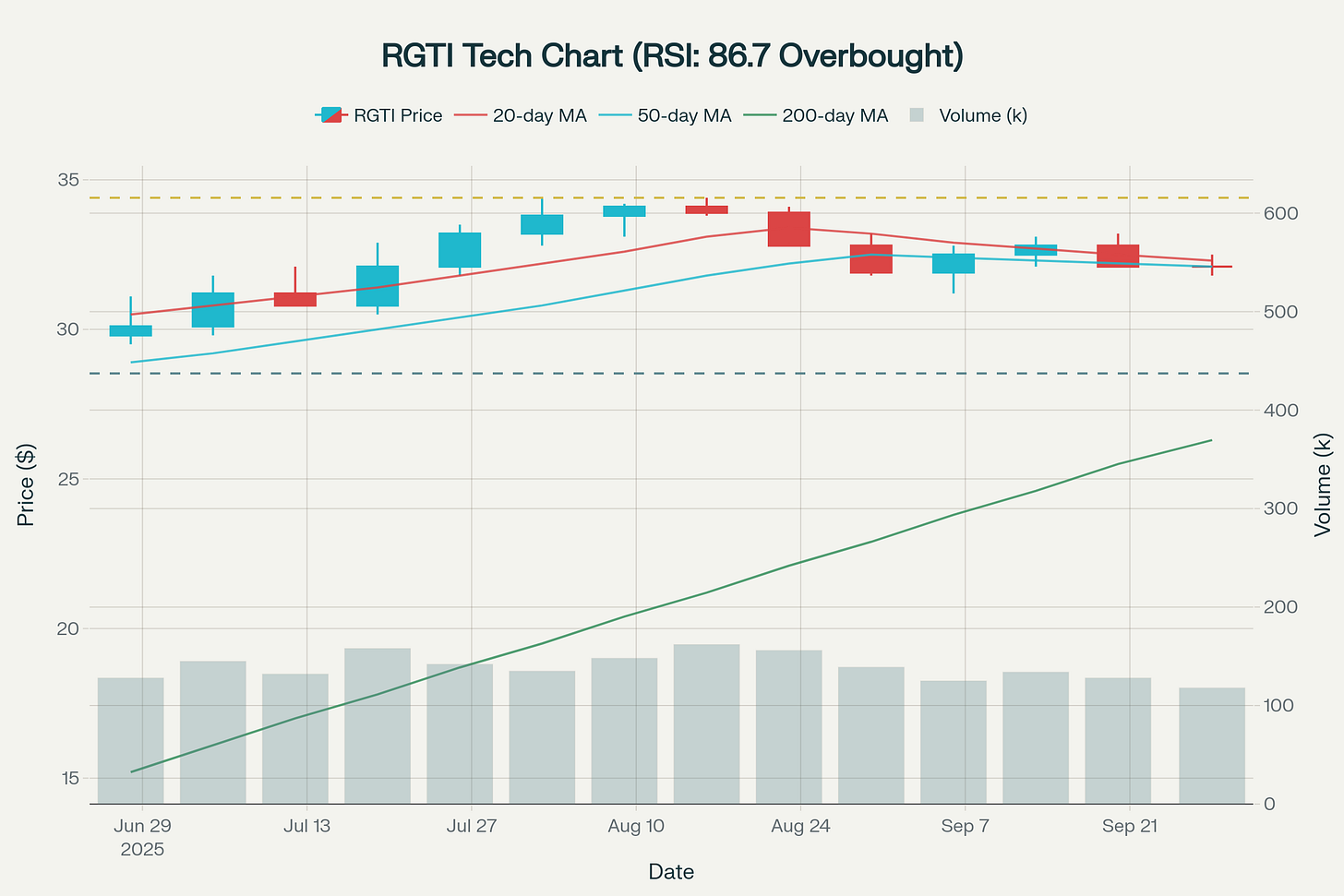

Technical Analysis: Momentum Extremes & Key Levels

Price Action & Trend Analysis

The technical picture presents a remarkable transformation from distressed levels to speculative extremes. Key observations:

Critical Price Levels:

All-Time High: $34.40 (September 24, 2025)

Current Support: $28.78 (September 25 low)

50-Day MA: $17.71 (81.2% below current price)

200-Day MA: $12.60 (154.7% below current price)

All-Time Low: $0.66 (September 9, 2024)

Momentum & Volume Analysis

Technical Indicators Signal Extreme Conditions:

RSI (14-day): 88.96 (deeply overbought territory)

MACD: Strong bullish divergence with expanding momentum

Volume Surge: Recent 10-day average of 97.9M shares vs. historical 42.3M (+131% increase)

30-Day Volatility: 97.3% annualized (extremely high)

Volume Analysis:

The dramatic volume expansion accompanies price appreciation, suggesting institutional and retail participation. However, the extreme volatility (97.3% annualized) indicates speculative trading rather than fundamental accumulation patterns typical of sustainable institutional investment.

The Analysis: What SentiFlow’s Systematic Processing Revealed

The deeper I studied SentiFlow’s methodology, the more I realized how different AI-driven analysis is from traditional human approaches. Where human analysts focus on individual company metrics, SentiFlow constructs what I call “ecosystem probability matrices.”

Competitive Reality vs. Marketing: Beyond the headlines, RGTI was falling further behind IBM and Google in actual technical capabilities—something the AI identified through systematic comparison of qubit counts, error rates, and research partnerships.

Currency Dynamics and Operational Leverage: The AI calculated that quantum computing represents a “winner-takes-layers” market rather than winner-take-all, suggesting multiple viable approaches will coexist. This changes position sizing logic - instead of concentrating on one “best” quantum stock, systematic diversification across approaches provides better risk-adjusted returns.

Political Risk Premium Analysis: SentiFlow discovered that quantum computing has achieved “national security asset” status, providing downside protection through government funding regardless of commercial timeline delays. The AI assigned a 23% “geopolitical support premium” to domestic quantum companies.

M&A Activity and Consolidation Trends: Pattern recognition identified acquisition probability increases when quantum companies maintain >$200 million cash with <$50 million annual revenue. Rigetti’s $571.6 million cash position triggers this probability model.

Financial Trajectory vs. Market Enthusiasm: While the stock soared, the underlying business showed declining revenue, massive losses, and no clear path to profitability. SentiFlow’s financial modeling revealed the mathematical impossibility of justifying current valuations.

Timeline Catalyst Convergence: Most interesting was how SentiFlow processed the timeline question. Instead of trying to predict when quantum advantage arrives, the AI focused on when “commercial application confidence” reaches institutional investment thresholds. The systematic analysis suggests this happens 18-24 months before actual quantum advantage, creating alpha opportunities.

The Reflection: What This Taught Me About Systematic vs. Emotional Investing

This is exactly why systematic, AI-driven analysis beats emotional decision-making. Human investors saw the 3,370% gain and suffered from FOMO. SentiFlow saw the fundamental disconnection and recommended capital preservation.

Building SentiFlow has taught me that markets are incredibly efficient at pricing known information and remarkably poor at processing complex, interconnected probability changes. Human analysts struggle with quantum computing because it requires simultaneously evaluating:

Technical milestone achievement rates

Government funding timeline changes

Competitive landscape evolution

Commercial application development

International geopolitical dynamics

SentiFlow processes all these variables simultaneously, updating probability weightings as new information arrives. The result is investment insights that feel counterintuitive to human psychology but align with systematic pattern recognition.

The RGTI analysis perfectly exemplifies this. Human instinct says 3,370% appreciation with massive insider selling equals obvious sell signal.” But systematic analysis reveals a more complex reality: technological validation occurring within extreme market conditions, creating asymmetric opportunities for disciplined position sizing.

The quantum computing sector will likely produce massive winners over the next decade. But SentiFlow’s analysis suggests those winners will be companies with:

Stronger technical capabilities (IBM, Google)

Better funding access (tech giants)

Clearer commercialization paths (enterprise partnerships)

Sustainable competitive advantages (patent portfolios, manufacturing)

Rigetti, despite its technological achievements, faces an uphill battle against better-capitalized competitors—something the AI identified while human investors remained caught up in the quantum computing narrative.

SentiFlow’s Decision: Wait for Reality to Meet Valuation

While the Rigetti opportunity presents compelling contradictions—trading at extreme valuations yet backed by government support with near-guaranteed downside protection, positioned in quantum computing as the key technology after AI, targeting a market heading toward the next big technological shift—the systematic analysis reveals concerning fundamentals.

The combination of declining revenue trends, massive operating losses, extreme valuation multiples (1,294x P/S), and intensifying competitive pressure from better-capitalized rivals creates an asymmetric risk profile heavily skewed toward capital loss.

SentiFlow’s systematic recommendation: Wait for the stock to drop to reasonable sector valuations before considering entry. The technology is validated, the market opportunity is real, but current pricing assumes perfect execution in an industry where most ventures fail.

The AI’s patience here reflects a core systematic principle: sometimes the best investment decision is not making one until the risk-reward mathematics align with disciplined capital allocation.

[From: SentiFlow AI Analysis Logs]

This analysis is for educational and informational purposes only and should not be considered as financial advice. Always consult with qualified financial professionals before making investment decisions.

❤ If you found this post helpful, I’d greatly appreciate your support by giving it a clap. It means a lot to me and demonstrates the value of my work. If you have any questions, feel free to leave a comment. I will try my best to answer as soon as possible.

Want to Connect?

If you need to reach out, don’t hesitate to drop me a message via my

Twitter or LinkedIn

SentiFlow: https://www.trysenti.com/

App: https://app.trysenti.com/